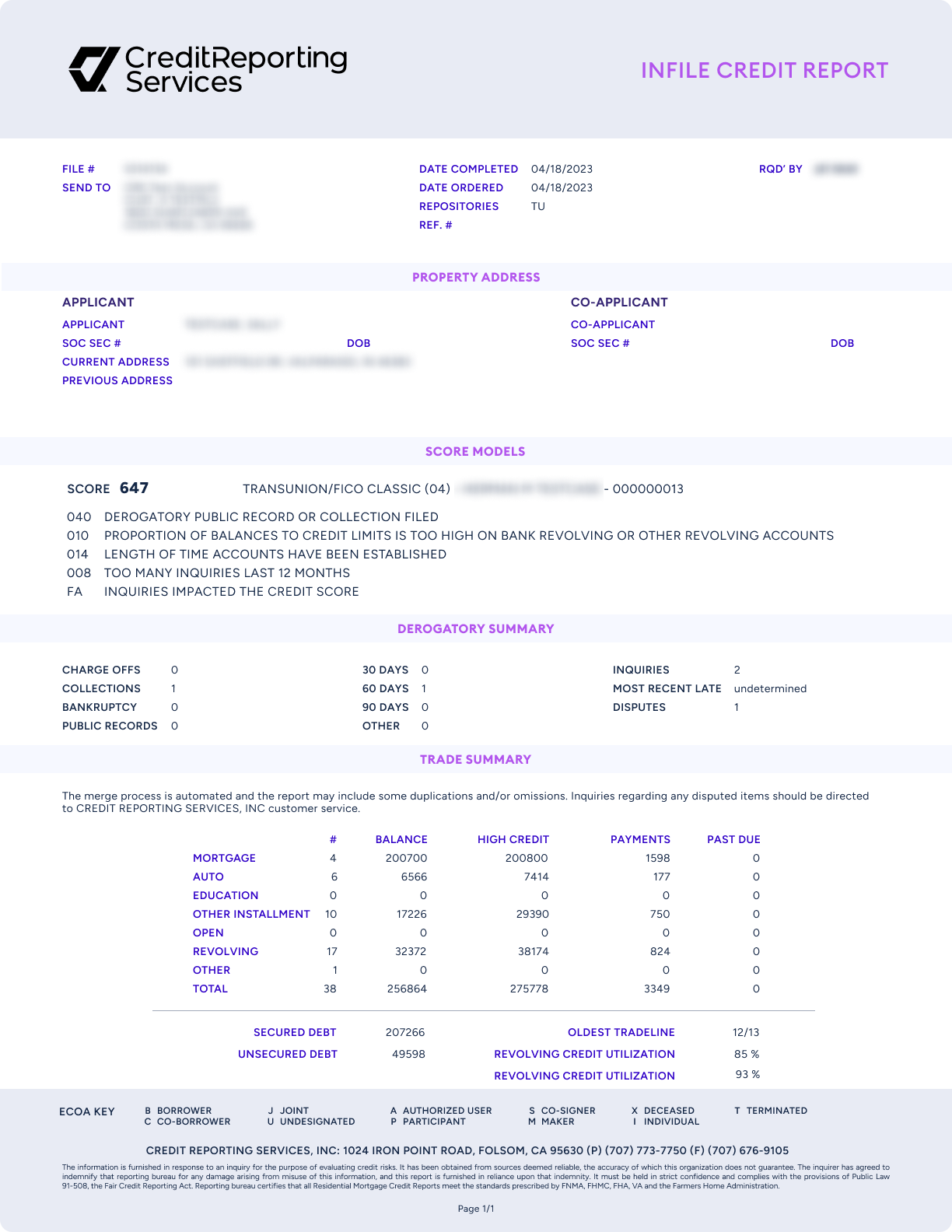

At CRS, our mission is to simplify the complexities of credit data for financial institutions. We are excited to introduce a revolutionary product designed specifically for lenders – CRS PDF Credit Reports.

In the world of lending, quick and informed decision-making is paramount. Whether you’re a bank, credit union, or a lending platform, understanding your borrowers’ creditworthiness is essential. However, working with multiple credit bureaus’ reports can often be a cumbersome and time-consuming process, making it challenging for lenders to assess and approve loans efficiently.

Why Use Our Credit Reports?

- Uniform Format Across All Bureaus

One of the most significant challenges for lenders in the credit industry has been dealing with the inconsistent report formats from different credit bureaus. This lack of standardization can lead to confusion, inefficiency, and delays in loan processing. At CRS, we understand these challenges, and that’s why we’ve developed CRS PDF Credit Reports.

Our reports are available from all major bureaus in a consistent, standardized format. Say goodbye to deciphering varying layouts or struggling to compare data between bureaus. With CRS PDF Credit Reports, you’ll have access to a uniform, lender-friendly format that simplifies the credit analysis process.