Credit Bureau Integrations

Hassle-free access to the credit data you need from credit bureaus

You already know why you need access to your customers’ credit data. The problem? Getting that data in a streamlined, timely, and compliant manner. Let us take it off your hands. See how our experts can help you!

Minimize risk with reliable data in weeks, not months

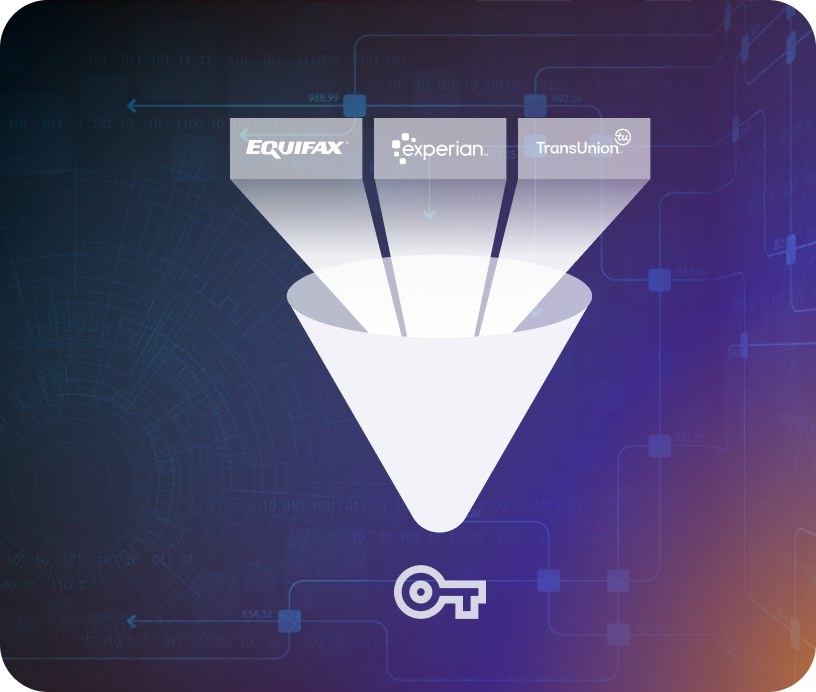

You’re not in the business of gambling, so why take the risk of exposing yourself to defaults? Our credit API aggregates data from Equifax®, Experian®, and TransUnion®, so that you can be sure that you only approve qualified borrowers. CRS makes credit data access simple with:

- Compliance services to guide you through bureau vetting and approval

- Managed bureau integrations that save you hundreds of hours of data integration testing

- All the data you need for Equifax® credit report API or Equifax® credit score API from a single user-friendly API system. We cover all 3 major credit bureaus, in addition to Equifax®

- Ongoing compliance services to satisfy complex regulations (failure to do so could get you permanently banned from accessing any credit data in the future)

We do the heavy lifting you reap the rewards

Your business has its own unique value proposition. This is ours – helping you access the credit data you need in the fastest and most cost-efficient manner possible through our proprietary API. But that’s not all. When you work with us, you get:

A single point of access

All the data you need from a single user-friendly API. One source, one insertion order, and one streamlined process.

Assistance in navigating integration landmines

Integration may be a simple word, but the process can be anything but. We will work closely with you every step of the way to help you navigate all the common technical “landmines.”

Education on relevant regulations

Fair Credit Reporting Act is currently 115 pages and almost 40,000 words long. Even small missteps can trip businesses up and risk them getting permanently barred from accessing future data. Our vast experience in this area helps prevent you from making such business-killing mistakes.

Continuous compliance support

Compliance is not a “once and done” thing. Even after a successful integration, businesses must keep a close eye to ensure they stay within its sometimes-hazy boundaries. We provide continuous education and post-integration support to ensure you don’t accidentally step out of line.

FAQs

What types of credit data can I access through your Credit API?

We can give you access to a wide variety of reports, including credit scores, income score models, income verification data, asset verification data, bankruptcy, and lien data reports, business credit reports, self-employment verification, and business identity reports.

Such data is highly useful for many industries such as:

Landlords and Property Managers:

Strengthen your tenant screening process and reduce your chances of getting stuck with bad and combative tenants.

Bankruptcy Attorneys:

Free up your time, handle a larger caseload, and help more people.

Automotive Lenders:

Turbo-charge your background checking process by cross-referencing data from all three credit bureaus.

Consumer Lenders:

Ensure you only approve qualified borrowers. Maximize your returns and minimize your risk.

Investment/Asset Managers:

Can only accredited investors access your products? Credit data plus our fraud verification and detection products – can ensure your onboarding qualification is streamlined and robust.

Marketers:

Quickly filter and segment customers, as well identify potential upsell and cross-sell opportunities.

Can you help me get approval from the credit bureaus?

Yes – that is a core part of our offerings. Once you finalize your contract with us, one of our friendly Customer Support Managers will get in touch to request some simple documentation. We will use that to perform a complete analysis of your business to validate your permissible purpose for accessing credit reports.

We will complete the internal vetting process directly with all the bureaus on your behalf. You never have to contact any of the product or service suppliers directly.

Will I have to retrain my team to learn an entirely new process?

You won’t need to overhaul your existing processes to get access to instant credit reporting. The whole idea is to increase your efficiency – not make things more difficult. Our products provide intuitive shortcuts that make obtaining and analyzing credit data faster and easier than you have ever done before. Your team will thank you for it.

Can I make both hard and soft data credit inquiries?

Yes, you can make both hard and soft credit data inquiries through our Credit API.

Can I access credit data without having to go through integration?

Yes, the choice is yours. You can choose to access the data through our convenient web portal instead. We will provide you and your team with login credentials.

Doesn’t Equifax® already have an API?

Yes, Equifax® does indeed have an API. But you will be limited to only Equifax® data. On the other hand, by integrating with us, you will get access to credit data from Equifax®, as well as TransUnion® and Experian® – all through a single API.

How long will it take to integrate the Credit API into my software or CRM process?

The speed of your integration will vary depending on your setup. If you are using a supported CRM platform, you could be up and running overnight thanks to our turnkey solution. A custom integration could take a little longer.

But, fear not. While the integration is ongoing, you will still have immediate access to the credit data you need through our web portal. During your free consultation call, one of our experts will advise you on the estimated time integration would take for your software and workflow.

How much will it cost to integrate Credit Reporting Services into our processes?

The cost of your integration will depend on your needs and current setup. We offer competitive pricing with enterprise-level support, with no monthly minimums for most of our products. One of our team members can give you a cost estimate during your free consultation call.

Do you provide integration and development support?

We work closely with your developers to integrate our tools with your platforms. We also have an extensive library of resources and documentation to help ensure a pain-free integration process. And even if you do not have your own developer, we can help you outsource the integration of our tools. You will also have access to 24-hour customer service at every point along the way.

Do you provide ongoing customer support?

To us, integration is just the beginning. We are committed to helping you succeed at every point in your journey. Just because integration is complete does not mean we stop providing you with world-class customer support. All our customers have a dedicated point of contact as well as access to a 24-hour contact line for instant customer support.

I’m not getting a response from the credit bureaus – can you help?

Here’s the good news – you won’t need to deal with the credit bureaus at all! Our customer service department will handle all direct communication with the credit bureaus internally, so you can spend more time on what really matters – your business.