Credit monitoring

Your Customer’s Ultimate Credit Tool

What Is eCredit Monitoring?

Credit Monitoring for Your Customers

monitoring features

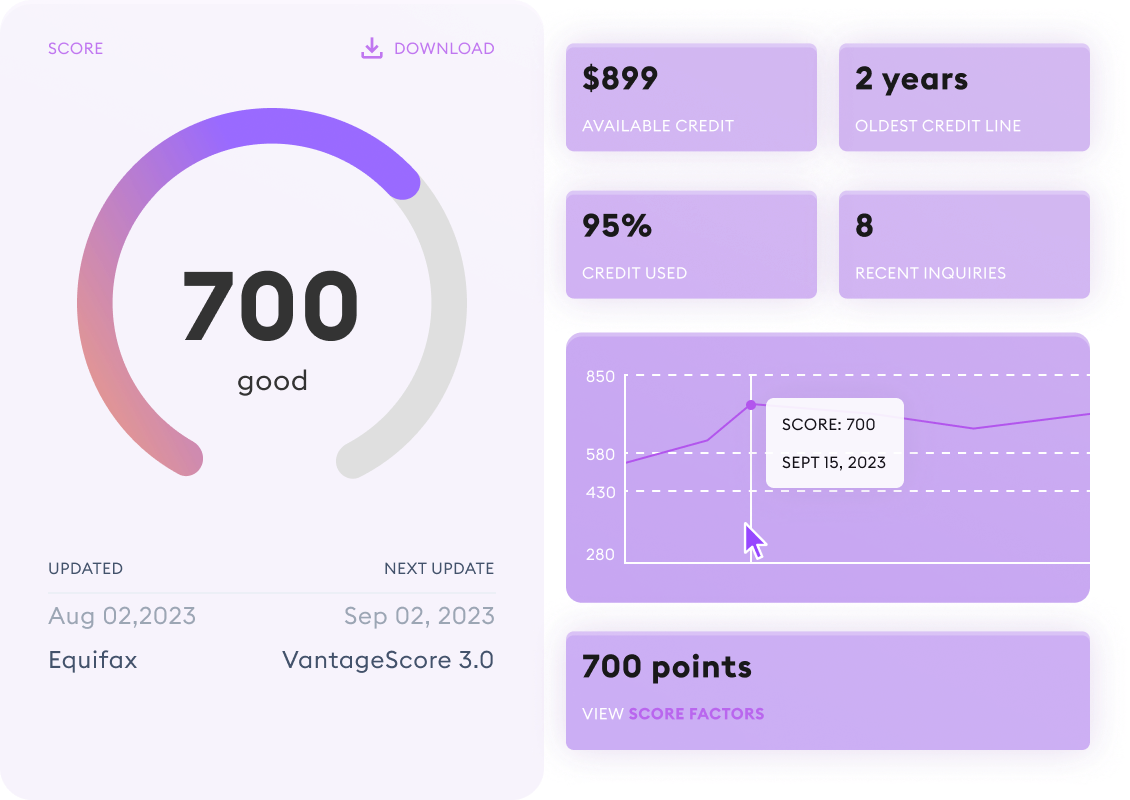

Tools for Tracking Credit Health

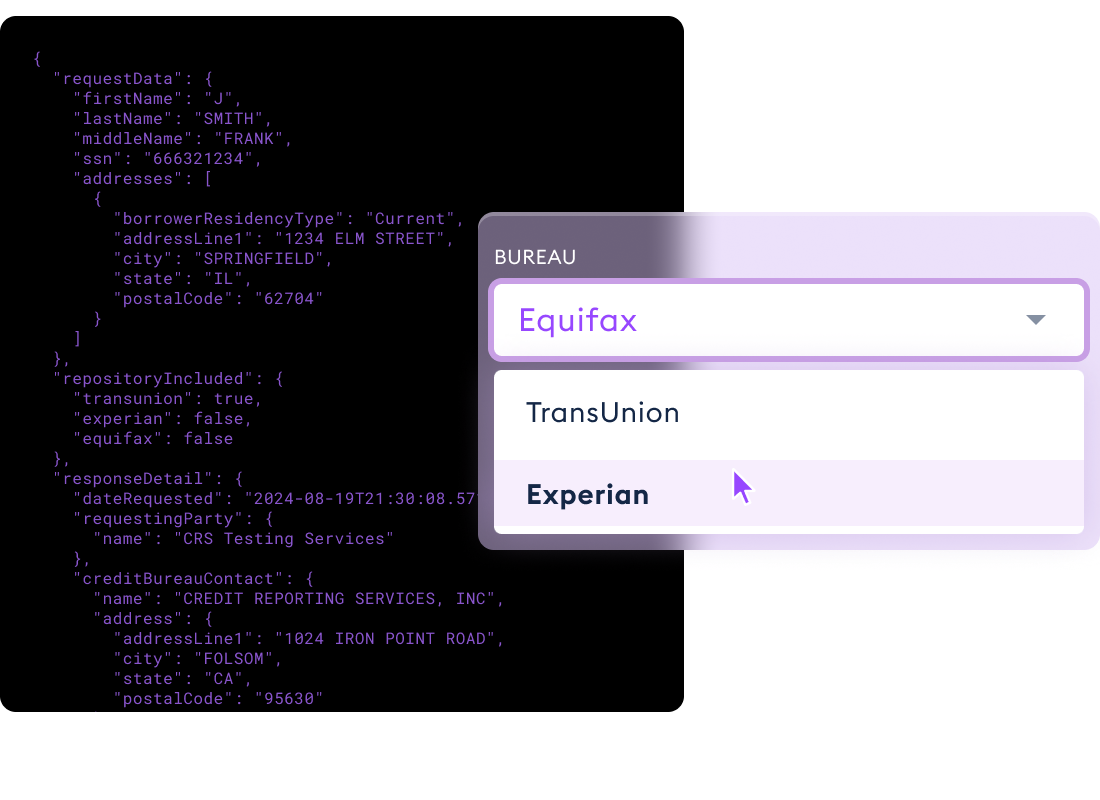

Easy Integration Options

![]()

iFrame Widget

is a fast solution, requiring only a simple copy-paste of the iFrame code into your HTML. It’s ideal for businesses needing rapid deployment without developers and can be live in about 30 minutes.

![]()

Hybrid Widget

combines API endpoints with the iFrame for seamless login and improved user experience. Setup takes roughly one day, perfect for quick and user-friendly integration.

![]()

Full API Integration

offers full customization for your app or website, ideal for businesses with development teams. It allows complete branding and tailored interfaces, with an implementation time of about two weeks.

Easy integration

The CRS Advantage

<html>

<head>

<title>eCredit Monitoring</title>

<meta name="description" content="CRS Consumer Credit Reports"/>

<link rel="icon" href="/favicon.ico">

<style>

body { background: #F9FAFB; }

#sc-iframe { border:none;overflow:hidden;padding:0px;margin:0px;

width:100%;height:100vh;z-index:1;position:absolute;left:0;top:0; }

</style>

</head>

<body>

<iframe id="sc-iframe"

src="https://efx-dev.stitchcredit.com/api/users/start?key=[API-KEY]&ocf=[FLAGS]&oct=[COLOR]&view=[VIEW-OPTION]&ocl=[LOGO-URL]"

width=“100%” height=“100vh”>

</iframe>

</body>

</html>

![]()

Branded to you

Tailor our white-label credit monitoring widget’s appearance to seamlessly align with your brand’s visual identity, and make stronger, more personalized connections with your customers.

![]()

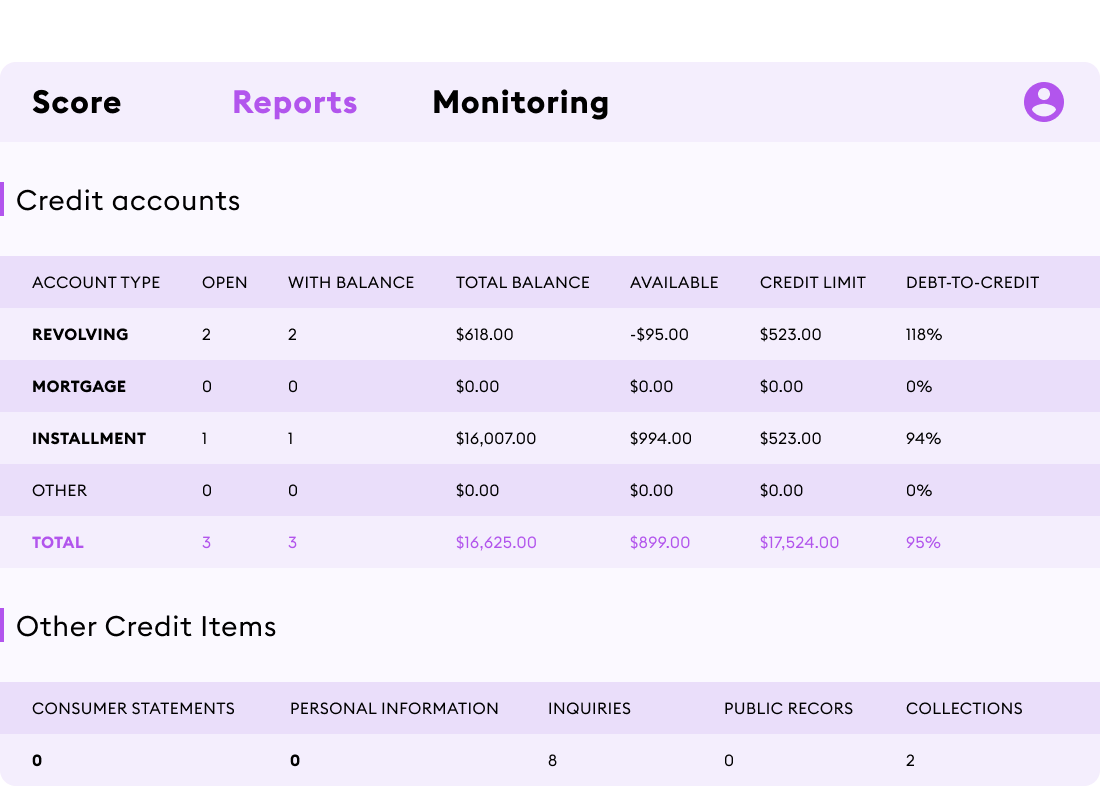

Diverse credit data

Provide comprehensive credit data, including VantageScore credit scores, the top four score factors, score history trends, and real-time credit reports upon enrollment.

![]()

Daily credit tracking

Get alerts to changes in customers’ credit files through both single-bureau or tri-bureau credit file monitoring options, and ensure timely action to protect the credit well-being of your client base.

Ready to get started?

Selection

Our sales team will help you choose the right product and solution for your needs.

Compliance

Our compliance experts will guide you through the vetting process with ease.

Activation

Our technical team will ensure smooth setup, whether you need API integration or web access.