Partners

Offer your Customers an All in One Solution

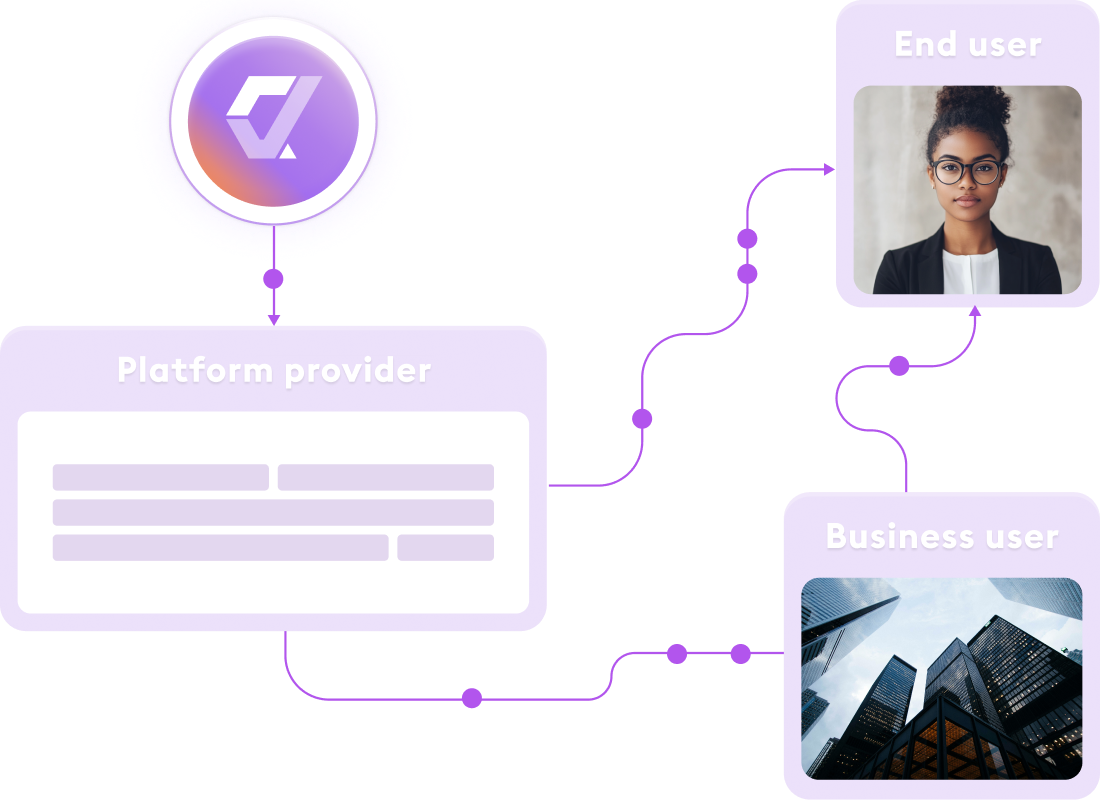

What is a platform provider?

Power your Platform

with our Data

![]()

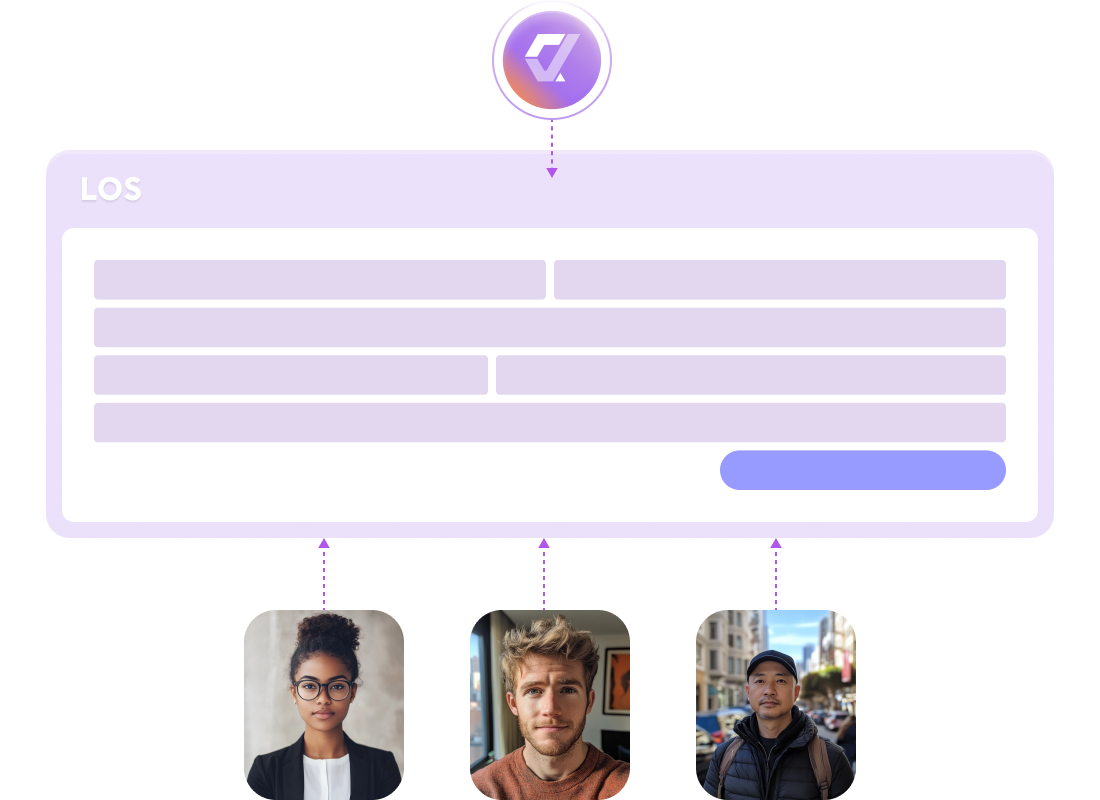

Loan Origination

Our one API enables quick and seamless credit data access, speeding up approvals to enhancing user satisfaction.

![]()

Loan Management

Gain real-time credit data for better portfolio tracking and risk management, improving loan servicing efficiency.

![]()

Credit Decisioning

Access reliable data for fast and accurate credit decisions, reducing risk while boosting platform credibility.

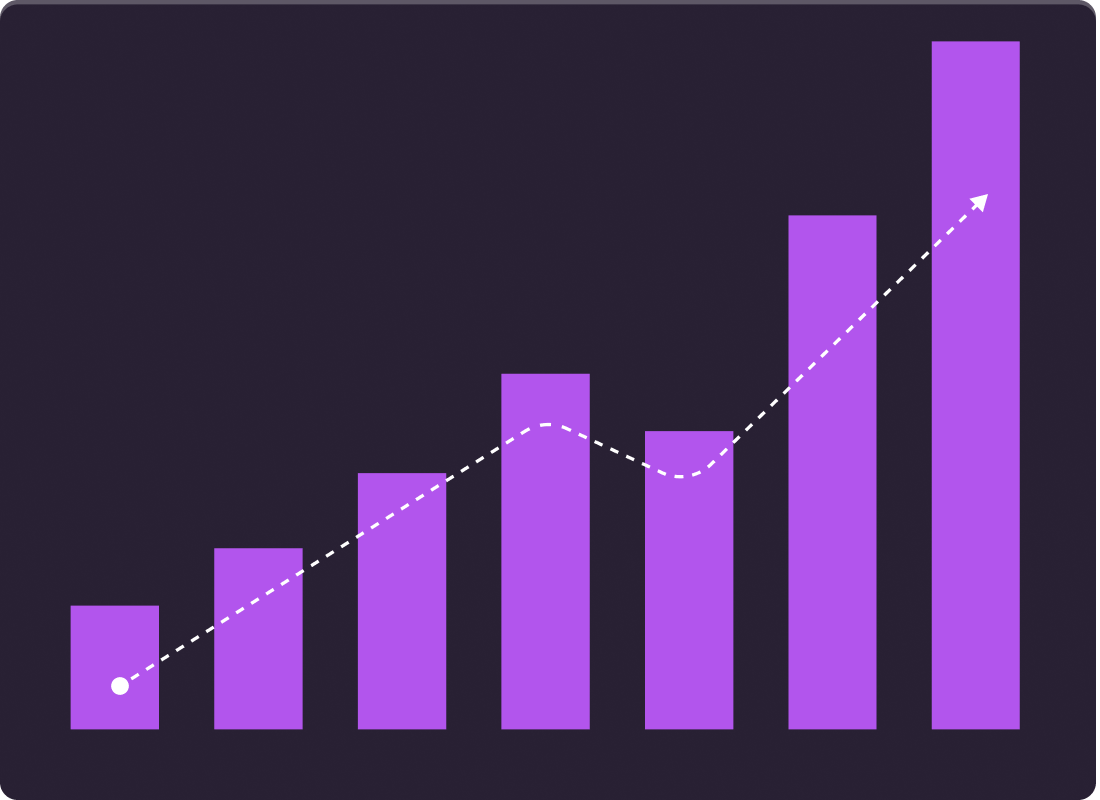

Designed for scale

Grow your Revenue

![]()

Expand Your Services

With CRS’s streamlined compliance process you are enhancing customer experience while rounding out data requirements in a single platform.

![]()

Access Exclusive Support

Benefit from dedicated support, training, and resources from CRS to ensure seamless integration and maximize your success as a channel partner.

![]()

Drive Revenue Growth

Increase your revenue potential with CRS’s high-demand solutions, helping you attract new clients and deepen existing relationships.

How Does it work

No Technical Integration Needed for End Users

Designed for developers

Effortless integration

No training required

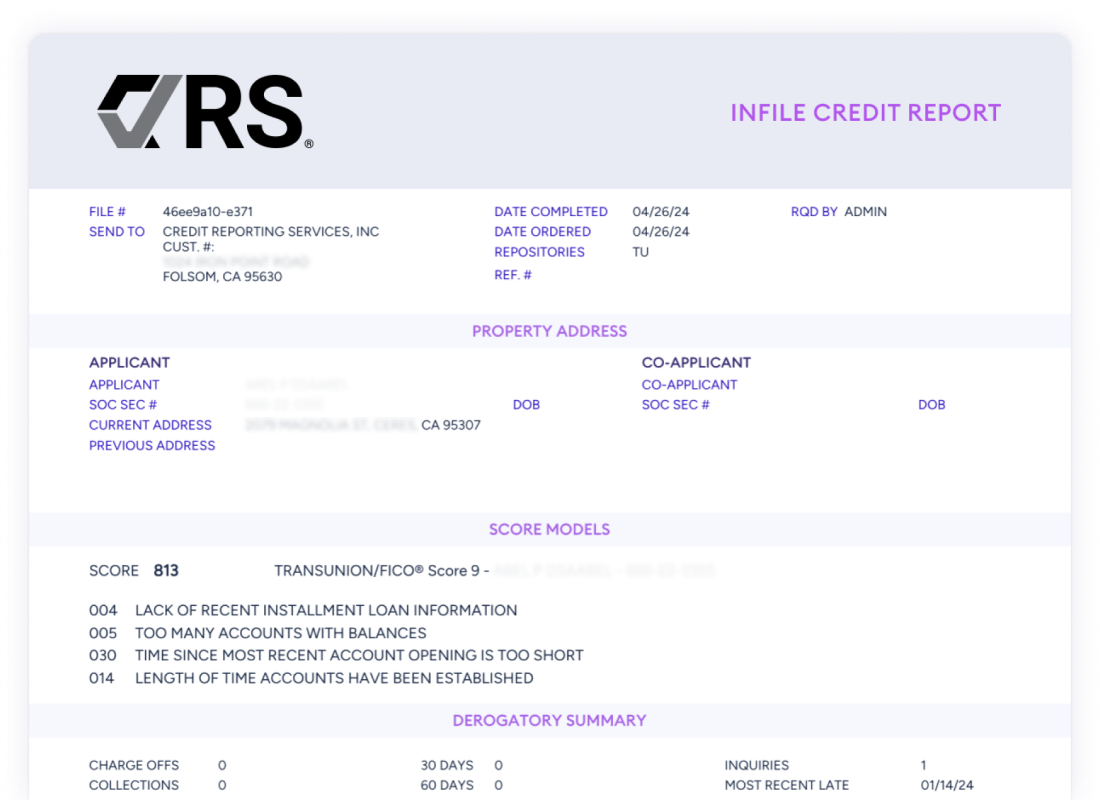

CRS Standard Format

Credit Data Made Easy for Small Lenders

While developing a lending platform, the company sought to integrate credit data but lacked clarity on requirements. Major bureaus wouldn’t work with smaller businesses, leaving them without guidance on technical and regulatory standards.

CRS provided expert support, establishing a seamless API connection and an intuitive onboarding portal for banks. Users gained easy access to regulated data and a single point for multiple report types, including OFAC and SBSS. The platform’s success solidified CRS as their long-term credit data provider.

Solutions is an innovative technology company created to help lenders offer a superior online experience today’s customers expect.

Lenderful

When we were developing our lending platform, we knew we wanted to integrate credit data but didn’t know exactly what we needed. We initially reached out to the bureaus, but they didn’t work with smaller companies like ours.

That’s when we found CRS.

CRS not only helped us meet our immediate needs by establishing a prequalification motion, but also educated us on everything we needed to know from a technical and regulatory standpoint.

Connecting the API was seamless, and the results were easy to retrieve and interpret. The portal for onboarding is incredibly user-friendly, which is a relief for the banks and credit unions we serve. It simplifies document finding and signing, and streamlines operations for our users to get quick access to regulated data.

Our customers love to hear they’ve got options to pull all kinds of reports through a single connection, including soft credit pulls, OFAC, MLA, and SBSS.

We’ve never used another credit data provider, and with the success we’ve seen, we don’t plan to.

Get Started Effortlessly

All options to get started

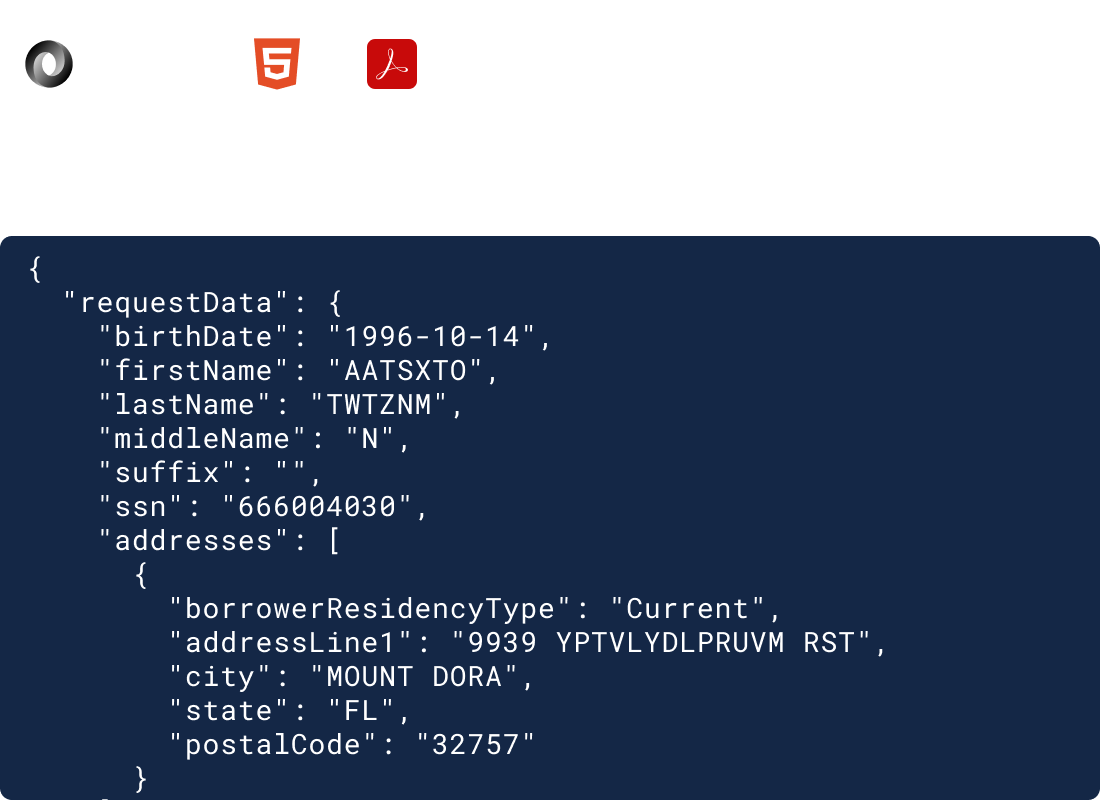

Full System Migration & End-to-End Replacement

Seamlessly transition from your outdated credit reporting system to a modern, efficient platform. No hassle, just better performance and compliance.

Custom Credit API Integration

Integrate our credit reporting services directly into your existing platform with a customized API, ensuring real-time data and smooth operations.

Web Access for Small Businesses

No IT department? No problem. Access our easy-to-use credit reporting tools through a secure web portal designed for businesses of any size.

Ready to get started?

Selection

Our sales team will help you choose the right product and solution for your needs.

Compliance

Our compliance experts will guide you through the vetting process with ease.

Activation

Our technical team will ensure smooth setup, whether you need API integration or web access.