Credit Data for Tenant Screening

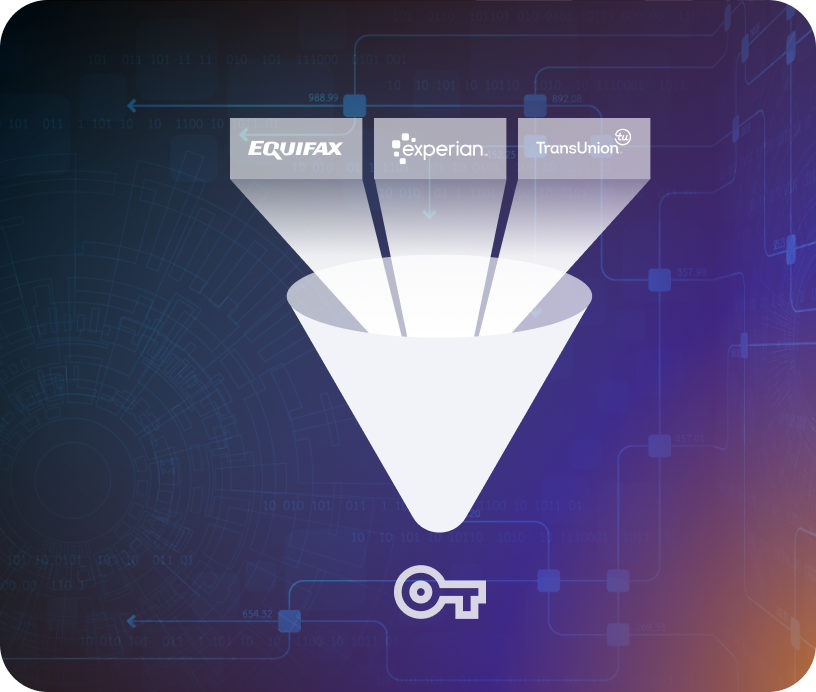

Instant tenant credit checks from Equifax, Experian, and TransUnion

You have better things to do than manually pull credit data on potential tenants. CRS makes it easy to instantly pull tenant credit and background checks from any credit bureau. We’re your all-in-one solution and trusted partner for tenant screening API and best-in-class services.

Avoid tenant defaults with real-time data

The best tenant screening services for property managers and landlords do all the hard work for you. At CRS, our tenant credit check and data products help ensure that your tenants meet your qualifying requirements, limiting your exposure to risk and rent defaults.

Soft pull credit reports

There’s a hard way to access credit data, and there’s an easy way. We’re committed to helping you find the shortest, quickest, least expensive path to the data that you need to make great decisions.

Soft pull credit reports

Easily perform soft pull credit reports from Equifax. Once you’ve matched a potential tenant’s credit data to your requirements, you can invite them to make a formal application request with peace of mind.

Simple integration to your platform

Access all of this data through our Credit API, which seamlessly integrates with your CRM and tenant application management platforms for an efficient application approval process.

Criminal and eviction reports

Ensure that you only approve the highest quality tenants by running criminal and eviction reports to assist you with the qualification process.

Save time with automated tenant credit and background checks

Our leading products will help ensure that all of your tenants meet your qualifying requirements, limiting your exposure to potential legal action and rent defaults.

Book a call with an expert

All of our experts have at least 20 years of industry knowledge and experience. They will walk you through the integration features and assist you with installation and activation.

Access tenant credit data

You’ll be able to access various data streams and reports through our platform or have them integrated seamlessly into your platforms.

Achieve positive returns

Quickly qualify tenants you can trust to respect the properties you manage, pay rent on time, and preserve the value of your clients’ real estate investment.

Tenant credit data property managers can rely on

Your time is valuable. There is no reason property managers and their teams should be spending their precious time collecting credit data.

At Credit Reporting Services, we create user-friendly and easy-to-integrate products that offer instant access to accurate tenant screening credit reports, so that you can dedicate your focus to signing the best tenant candidates.

FAQs

How complex is integrating and onboarding Credit Reporting Services into our process?

Our team provides step-by-step guidance to make the integration of our tools as seamless as possible. Our products are intuitive and easy to use which makes onboarding quick and easy. You’ll also have access to documentation and 24/7 customer service should you ever have questions or need additional support.

How long will it take to integrate Credit Reporting Services into my property management software or CRM?

The speed of your integration will depend on your current setup. We’ve already built turnkey solutions such as credit report integrations for Salesforce and Zoho CRM, which means we could get you up and running overnight, while a custom integration might take longer. We also provide you with access to our web portal so that you can start accessing reliable credit data immediately. To find out how long it would take to integrate Credit Reporting Services into your current software and process, talk with one of our credit experts today.

Will it be expensive to integrate Credit Reporting Services into our process?

The cost of your integration will depend on your needs and current setup. We offer competitive pricing with enterprise-level support and do not require monthly minimums for most of our products. To get an estimate of how much it would cost for your Credit Reporting Services integration, talk with a CRS credit expert.

Can Credit Reporting Services help us with compliance hurdles?

Yes, we can help you understand the compliance process quickly and efficiently. Our team’s working relationship with the bureaus and extensive experience in the credit data industry gives us the expertise to help better navigate the complexity of the compliance process.

What should we do about not getting a response from the credit bureaus?

Once you are integrated with Credit Reporting Services you will have instant access to all the data you need from all three bureaus, and will not have to worry about waiting for a response ever again.

How can we make sure to receive approval from the credit bureaus?

Credit Reporting Services completes the internal vetting process direct with the bureaus on your behalf and you may gain access to all three bureaus once our approval process is completed.

Can you help us get a permissible purpose to receive credit data?

Our team of experts help you navigate the credit data reporting industry so that you can easily and efficiently request credit data and have the permissible purpose to receive and consult it.

Do you provide both hard and soft data credit inquiries?

Yes, you can make both hard and soft credit data inquiries through our Credit API.

Can we access credit data without going through integration?

Yes, we provide you with access to data reports to all three bureaus through our web portal. We will provide you and your team with login credentials.

How can I access your documentation on Credit Reporting Services?

Once you speak with one of our credit specialists, you will receive a follow-up email with direct links to our document library. There, you will find report samples and the complete API documentation online. Once you have access to these documents, you will be able to view them as necessary or download them.

What does your vetting process look like?

Our vetting process is very efficient and quick. Once your Credit Reporting Services contract is finalized, one of our highly experienced Customer Support Managers will request some simple documentation and complete our internal analysis of your business to validate your permissible purpose for accessing credit reports. One vetting process will gain you access to all of the products and services we offer. There is no need for you to contact any of the product or service suppliers.

How do I run a credit check on a tenant?

To run a credit check on a potential tenant you must first obtain a complete Rental Application and a Permission to Run a Credit Check. Your applicant must be 18 years or older and must provide a form to fill out with their full name, birth date, social security number, previous address, and the contact information for their previous landlords of the past two years. You can also charge your potential tenant a credit check fee to cover your payment to the credit bureaus or credit check websites.

Does tenant screening affect a credit score?

Some landlords will pay a fee for a tenant credit check request to their Landlord Association. In some cases, a hard inquiry will show up on your credit report and cause a slight drop in your credit score. Landlords can also resort to Tenant Screening Services to pull credit reports on potential tenants.

What do agents see when checking my credit?

Agents and landlords who perform credit checks can verify whether you’ve had issues with paying bills in the past. A bad history might mean that you need to pay a bigger deposit check as a guarantee that you can pay your rent in full and on time.

What is the best software for landlords?

Many software programs can help landlords effectively manage their rental properties. Highly reputable software comes at different price points and can be useful for managing anything from a single unit to 100 units. These programs include Building, Rent Manager, AppFolio Property Manager, Propertyware, Rentec Direct, MRI Affordable Housing, Entrata, and ReMan Property Management. If you are using, or are thinking of using, any of these programs for managing multiple properties, please contact one of our credit specialists to supplement them with credit-API-integrated Credit Reporting Services.

What is the best credit check for landlords?

Experian®, Equifax®, and TransUnion® all offer reliable credit data for landlords. By gaining access to Credit Reporting Services, landlords can harness quality data from all three bureaus and easily and quickly screen quality tenants.

Does Credit Karma have an API for tenant background checks?

While Credit Karma does offer an API solution, it is not designed for tenant credit checks and property management software.

Does Equifax® have an API?

Yes, Equifax® has an API however it does not give you access to data from the other bureaus. By integrating with Credit Reporting Services you get access to data from Equifax®, TransUnion®, and Experian®. Learn more about how our Credit API integrates data from all three credit bureaus.