Are you wondering how to get started with using Credit Reporting Services (CRS)? This helpful guide will equip you with the information you need to learn how to use credit APIs with ease. Starting from the ground up, this guide covers the basics of integrating and onboarding CRS into your products, and introduces you to the key terms and concepts you need to know.

What is an API?

If you’re looking to integrate credit reporting APIs into your website or mobile app, it is essential to become familiar with APIs themselves – what they are, their uses, and how to use them. Anyone using websites or apps comes into contact with APIs all the time, but the term itself is not common knowledge outside of the programming world.

API stands for Application Programming Interface. APIs are tools used by programmers to expedite the process of developing a website or app. If you have ever seen a prompt on a website to “Sign in using Google” or “Sign in using Facebook,” you are looking at an API.

APIs save you and your company the trouble of developing a specific tool for your product from scratch. This is where third-party APIs come in. A third-party API is any API made for a website or app by a third-party developer – i.e. someone other than the website or app’s developer.

Third-party APIs are available for a variety of purposes. You can use one to implement a payment system into your website or app, add a sign-in function, or even give consumers access to credit reports. These consumer viewable credit APIs are an excellent addition to your product, as they allow a consumer the ability to conveniently access credit reports from within your website or app.

Third-party APIs are also useful for companies and businesses. Using APIs that can offer insight into consumer interactions with a product can benefit any company or business. Companies can use credit APIs to access consumer credit reports, as well as for numerous other purposes.

What is a Credit API?

A credit API is a tool within a website or app that gives companies or consumers access to credit reports and other credit reports and scores. Credit APIs are also used by companies and consumers to avoid fraud.

A good credit API gives users the ability to acquire full reports from the big three credit reporting agencies: Experian, Equifax and TransUnion. These agencies collect credit information from users independently of each other, so it is essential that a credit API can provide reports from the different agencies.

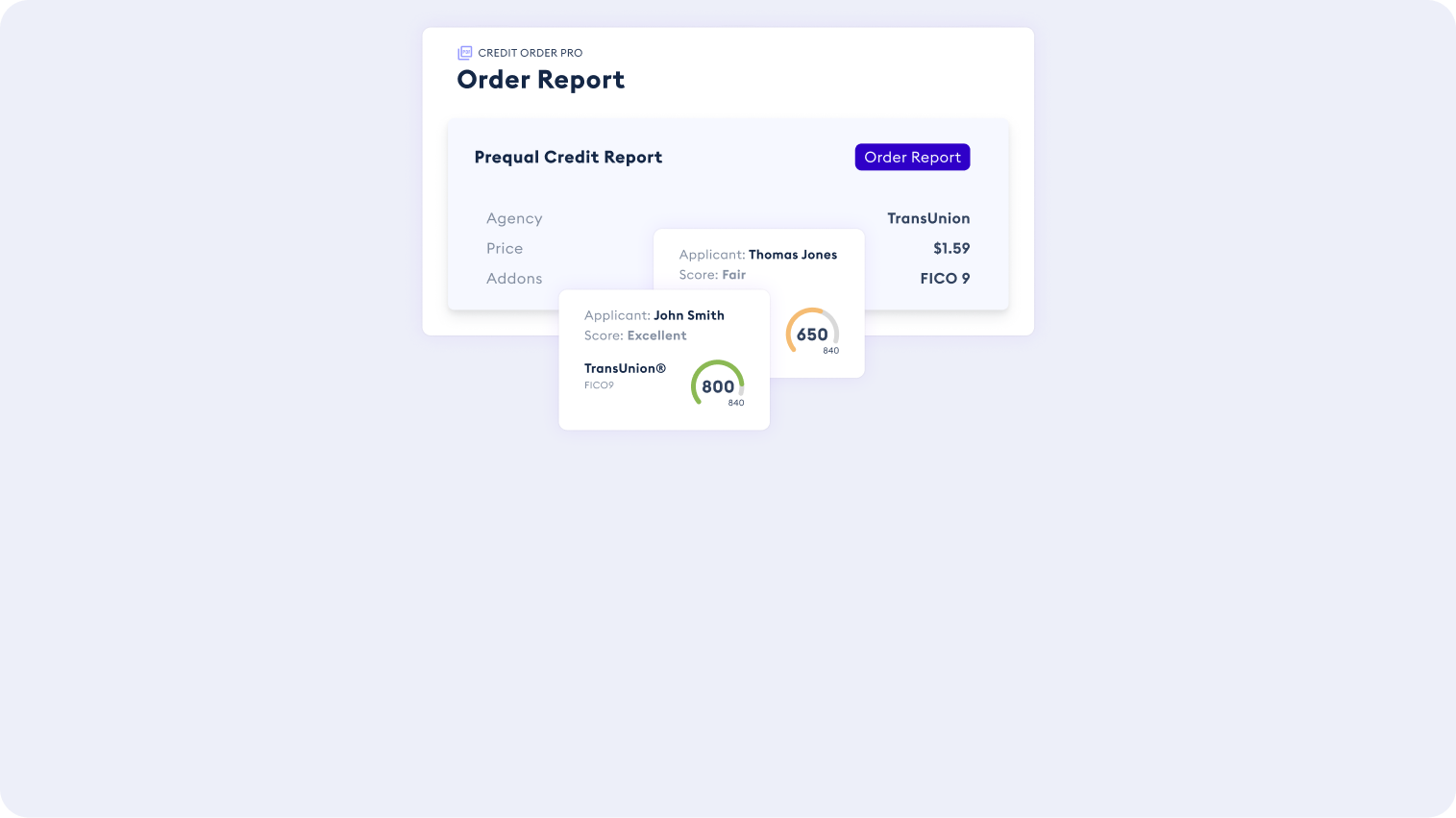

Some credit APIs are designed to be used by businesses, whereas some are consumer viewable. Credit APIs for businesses will provide resources for fraud detection, identity verification, portfolio management, and more. Consumer viewable credit APIs provide users of your website or app with a means to check their own credit scores with ease.

If you want to include a credit reporting feature in your product, a third-party credit API comes in handy. This saves you time and effort, and leaves you with a reliable premade tool to integrate into your website. The alternative of developing a credit reporting tool yourself or hiring someone to develop one for you, is significantly more difficult.

Why Use a Credit API?

Credit APIs give you and your company access to consumers’ credit reports, allowing you to make fully informed decisions. In addition, using a credit API helps to protect you and your and your company from fraud.

Providing a credit reporting API to consumers as a component of your product is beneficial for multiple reasons. Giving consumers access to their credit reports through your product connects them with your service and gives them an opportunity to interact with your product in a way that benefits them.

In addition, implementing a well-designed credit API into your product conveys to consumers that excellence and reliability matter to you. Including convenient resources such as a consumer accessible credit API builds loyalty to your brand.

A third-party credit API can also be customized to be cohesive with your business’s branding. This makes the addition of the API to your app or website seamless. Ideally, a third-party API will look like an organic extension of the website, not something external.

Using an API to give consumers access to credit reports within your website or app is beneficial because it keeps the consumer connected to your website or app. Linking to an external credit reporting website disconnects you from the consumer and loses the opportunity to offer them a useful service within your brand.

Uses for Credit APIs

Credit APIs are extremely useful tools for numerous types of companies and businesses.

For consumer lending, CRS streamlines the consumer loan qualification process by accessing reliable data from multiple bureaus to help you take the guesswork out of lending so you can make the decisions that matter.

For car loans, CRS is helpful in the process of underwriting. An automotive lender can use CRS to gain a consumer’s credit report data, ensuring that the consumer is reputable and fit for a loan. An automotive lender can also use an API to verify a customer’s identity.

If you are a landlord, credit reporting services can help you make wise decisions with tenants. You can use a credit API to determine who you should allow to live at your properties. Credit reporting services allow you to find all the information you need to screen a potential tenant.There are numerous other fields where credit reporting services are immensely useful, including CRM development, bankruptcy attorneys, and investor screening. Credit APIs come in different forms, with certain tools performing specific functions. To find out what credit API is right for you, assess your business’s specific needs and functions.

How Are Credit Reporting Services Implemented?

Implementing a credit API into your product may seem like a daunting task. Fortunately, the reality is that adding an API to your app or website is not too complicated. This is especially true in the case of the consumer widget, which is already pre-programmed to function, and all you need to do is add the code to your app or website.

When you add a credit API to your website, you are adding the API’s code into your site’s programming. The same goes for loading an API into an app. After you decide to proceed with a credit API, you’ll build out the credit API code into your website, and the credit API will function independently of any additional prompts or setup, as it is essentially a standalone program within your product.

A credit API can serve different purposes within your product. The process of implementing the credit API depends on what its purpose is for your company. If your goal is to gather credit information from consumers that will influence your decisions as a company, you will need to make sure you have all the prerequisites required for accessing consumer credit reports.

Credit APIs: Safe, Compliant and Streamlined

The setup process for using credit APIs involves a contract to ensure that prerequisites for accessing consumer credit reports have been met. This keeps your company’s use of credit APIs compliant, well-documented, and effective.

In addition, it is important to ensure that you have proper measures set up to protect consumers’ credit information. To protect users’ data in the event of a breach, a credit API should have security features in place. One of these features is IP restriction.

IP restriction prevents access to users’ data from any IP address other than the user’s own. If a data breach occurs, having IP restriction in place will protect your consumers’ data from being lost or stolen.

In addition, when using a credit API to access consumers’ credit reports, it is important to avoid storing this data in your system. Instead, you can access consumers’ credit reports using a reference number. This keeps the data out of your system but still accessible.

In Summary

Implementing a credit API into your product requires some knowledge and work, but it ultimately streamlines the process of getting you, your company and your consumers the resources you need. By making use of credit reporting services, you and your business can develop rapport with consumers, and come to a greater understanding of your customer base.

Now that you are familiar with the basics of what credit reporting services are and how to implement them, you are ready to find the tools that meet your company’s needs. Credit APIs can take your website or app’s functionality to the next level and offer your company the resources necessary to make confident decisions.