Introduction

In the ever-evolving landscape of lending, making informed credit decisions is paramount for lenders seeking to support the growth of small businesses. The quest for reliable tools that enable swift and precise credit assessments has led to the emergence of Small Business Scoring Service (SBSS) lending—a game-changing solution developed by Fair Isaac Corporation (FICO).

This innovative scoring model not only benefits lenders but also plays a pivotal role in securing Small Business Administration (SBA) loans and a wide range of other small business financing options. In this blog post, we delve into the world of SBSS lending, shedding light on how it empowers lenders to make smarter credit decisions, whether in the context of SBA loans or other small business financing endeavors.

What is SBA?

Before delving deeper into the benefits of SBSS lending, let’s take a moment to understand the significance of the Small Business Administration (SBA).

The SBA is a federal agency in the United States dedicated to supporting and empowering small businesses. It plays a pivotal role in facilitating small business financing through partnerships with approved lenders, offering favorable terms for loans that make them highly sought after by entrepreneurs.

Understanding the importance of SBA loans is crucial, as they provide critical funding for small business growth and development. When applying for an SBA loan, one essential requirement is to pull an SBSS score, a proprietary model tailored to assess the creditworthiness of small businesses seeking SBA loans.

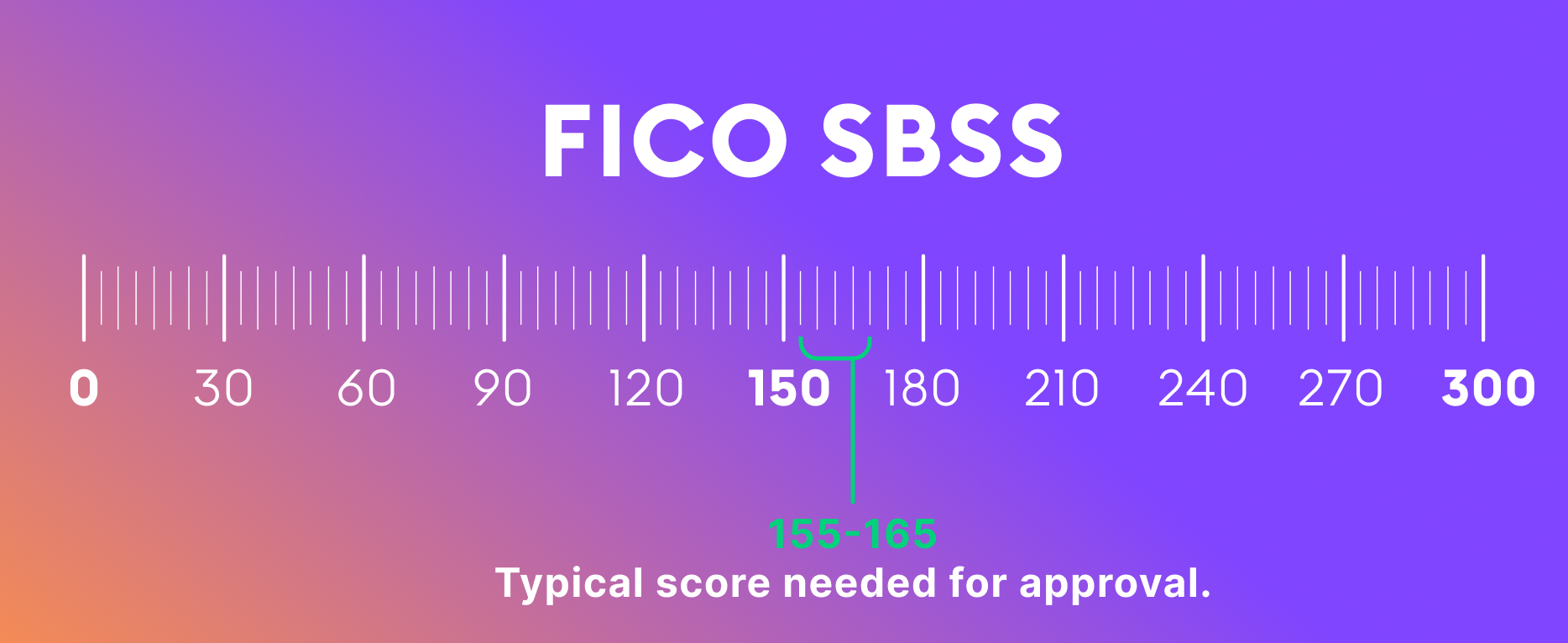

FICO’s SBSS score is a comprehensive tool that considers both business and individual credit data. The typical minimum SBSS score to qualify for these loans is around 140. Use of this score streamlines the approval process and enhances accessibility to these valuable lending products for both lenders and borrowers.

What is SBSS?

SBSS, or Small Business Scoring Service, is a credit scoring model developed by FICO to assess the creditworthiness of small businesses.

It is a valuable tool for lenders seeking to make informed lending decisions, whether they are evaluating SBA loan applications or other small business financing options.