Streamlining Credit Reporting: The Power of Data Furnishing

March 28, 2024

In the financial ecosystem, data furnishing serves as a crucial pivot point that can significantly influence a business’s credit journey and consumer relationships. At its core, data furnishing allows businesses to report consumer credit information to credit bureaus, helping customers build their credit history effectively.

But beyond the definition lies a world of benefits that can transform the way businesses interact with credit data and how they are perceived within the industry.

UNVEILING THE BENEFITS OF DATA FURNISHING:

The Impact on Delinquency Rates

Prompt repayment is the lifeblood of financial health for any business. Effective data furnishing incentivizes customers to make timely payments, as their payment behavior directly impacts their credit scores.

This not only promotes financial discipline but also ensures that businesses enjoy a healthier cash flow, reducing delinquency rates and fostering a stable financial environment.

Attract Credit Conscious Consumers

Today’s consumers are increasingly credit-conscious, recognizing the value of a strong credit history. By partnering with a data furnisher, businesses can attract those who are actively seeking to improve or maintain their credit score.

This not only reflects a commitment to consumer empowerment but also aligns business practices with customer values, fostering loyalty and trust.

Monitoring Made Easy

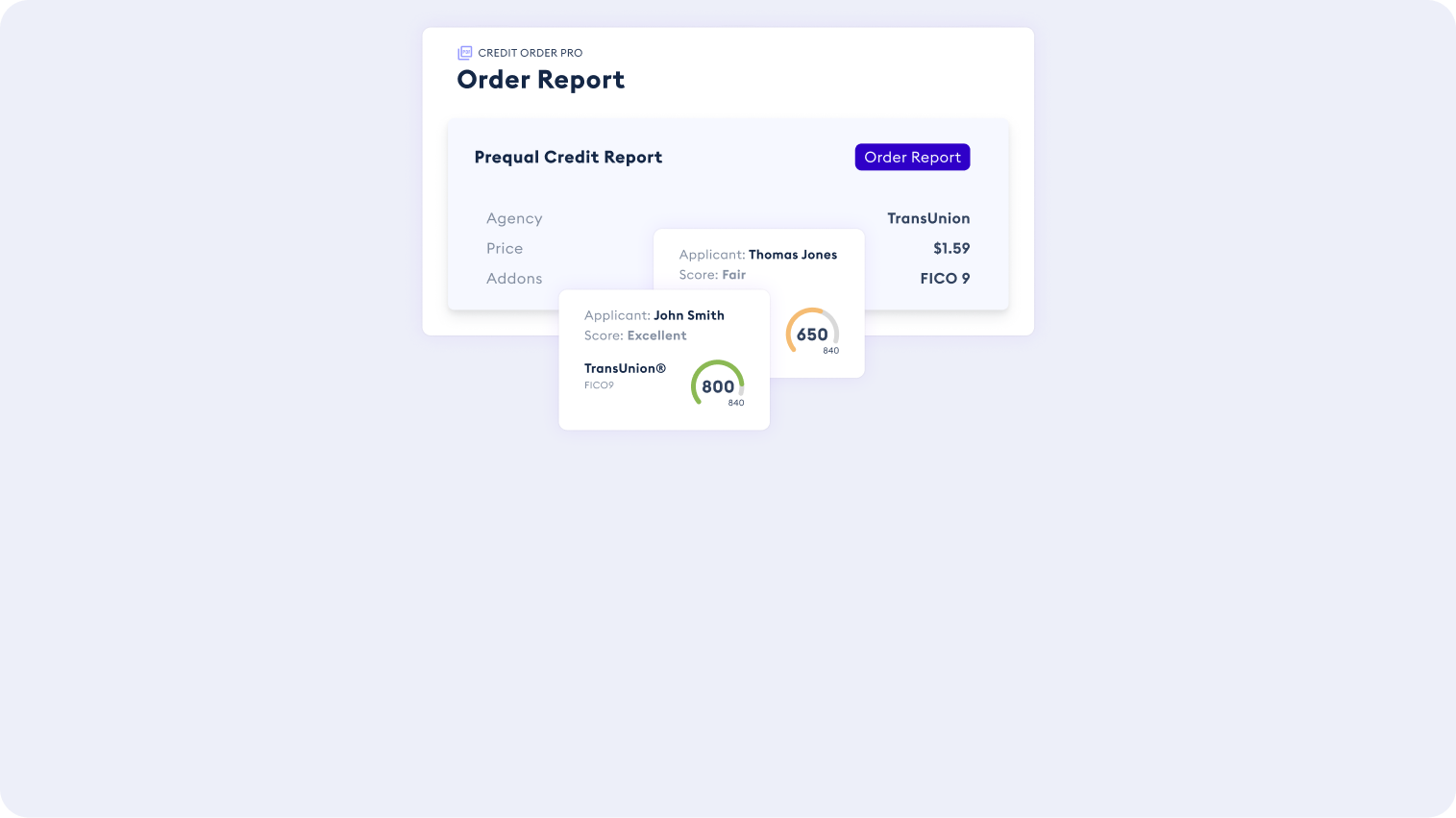

With an advanced platform, businesses can effortlessly track the credit data they report. This real-time monitoring ensures any inaccuracies are swiftly identified and rectified, maintaining the integrity of the reported data.

Continuous oversight means businesses can be proactive rather than reactive, leading to greater control over credit information.

The Path to Data Furnishing: A Long and Winding Road

Given the sensitive nature of credit data, obtaining a data furnishing license from the credit bureaus is deliberately designed to be a rigorous process. It involves navigating through a maze of regulatory requirements, setting up compliant reporting systems, and committing to continuous monitoring for accuracy and security.

This is a resource-intensive task that many businesses, especially smaller ones, find challenging to manage.

CRS: Your Shortcut to Efficient Credit Data Reporting

Working with CRS offers businesses a fast track to the world of data furnishing. CRS has already laid the groundwork, ensuring that the path to data furnishing is not only shorter but also far less fraught with compliance and technological hurdles.

By partnering with CRS, businesses bypass the arduous process of acquiring a license and directly tap into the benefits of a sophisticated credit reporting system.

Our Holistic Approach to Data Furnishing

When you choose CRS, you’re not just getting a service provider—you’re gaining a partner dedicated to the intricacy and precision of credit data reporting.

With CRS, the complexities of compliance, reporting, and data management are transformed into a streamlined process, tailored to the unique rhythms of your business operations.

Simplification of Reporting

The reporting process can be labyrinthine and fraught with compliance pitfalls. CRS’s structured data furnishing system, which is based on Metro 2, simplifies this intricate process, allowing businesses to relay credit information seamlessly.

This not only saves valuable time but also streamlines operational workflows, making credit reporting a less daunting task.

Industry-Specific Solutions

Each industry has its own set of reporting nuances. CRS’s approach is to offer tailored solutions that consider the intricacies of different market sectors, ensuring that businesses can report data in a manner that aligns with their specific industry standards.

Data Furnishing with CRS

Opting for CRS means choosing to navigate the credit reporting landscape with expertise at your side.

With a nuanced understanding of industry-specific requirements, a robust platform for easy data monitoring, and a streamlined process, CRS stands out as the partner of choice for businesses looking to improve their credit reporting functions

For businesses ready to step into a world where credit reporting is simplified, compliance is assured, and customer relationships are strengthened, CRS is the gateway to achieving that.

Contact CRS today to unlock the full potential of your business’s credit reporting capabilities.