A credit score provides an estimate of an individual’s creditworthiness based on an analysis of their credit report. Credit scores evaluate the risk of lending money to consumers. Modern credit scoring dates to 1956 when Bill Fair and Earl Isaac, the founders of Fair Isaac Corporation: FICO, created their first credit scoring system.

FICO Score and VantageScore

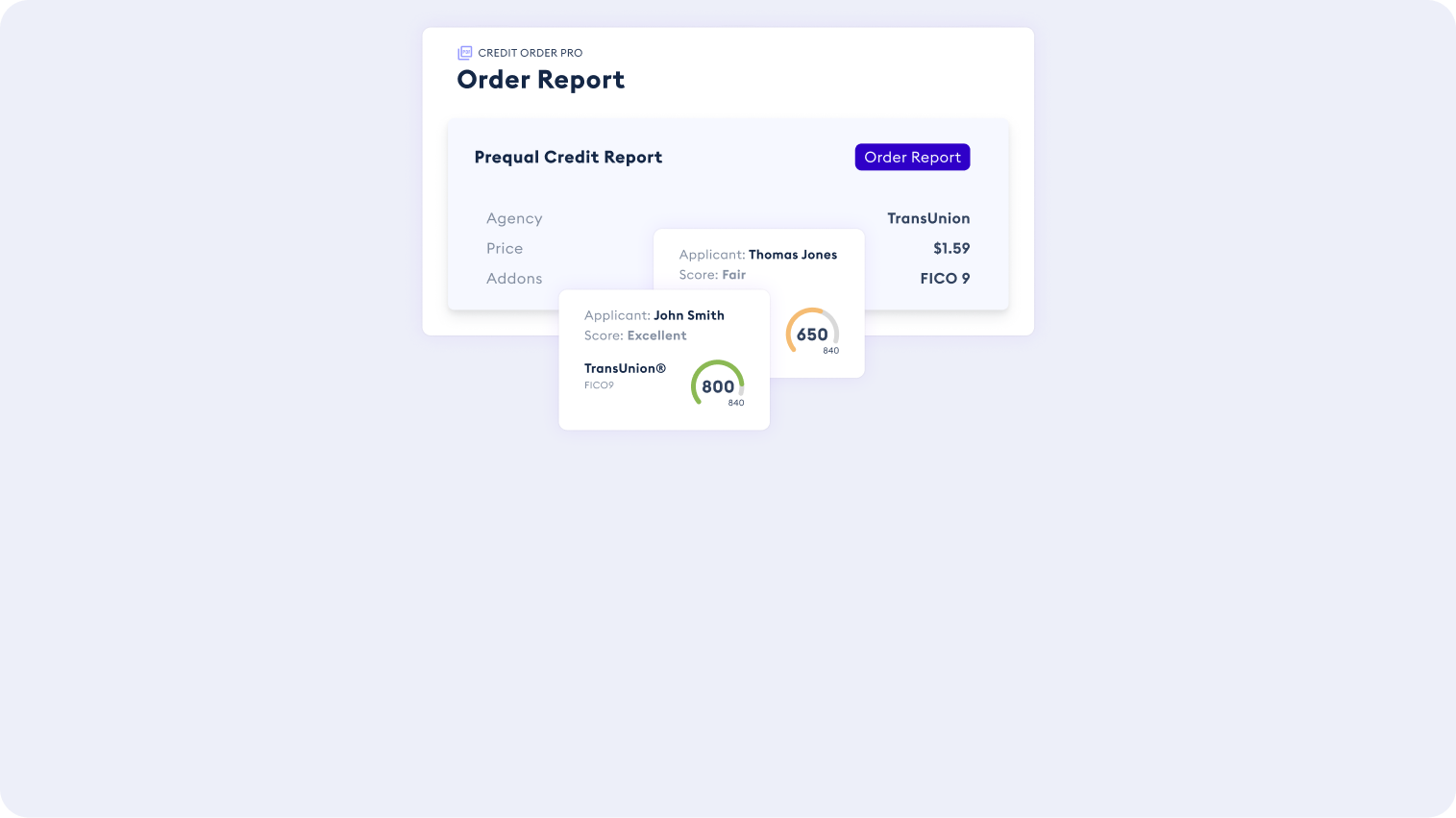

In the U.S., two credit score types have dominated the credit scoring industry. FICO Scores has been the industry leader since it was introduced in 1989, while VantageScore, which was created in 2006 as a competitor to FICO scores by the three major credit reporting agencies, Equifax, Experian and TransUnion, has been gaining market share. Both credit scores have similar models and usages, however each uses its own criteria and scoring model.

Similarities

FICO and VantageScore use credit scoring models that analyze a credit report to generate a number: the credit score. The scores attempt to predict the likelihood that, within the next 2 years, a person will be delinquent on a bill. For both credit scores, a higher score indicates less likelihood that a person will miss a payment. FICO Scores are from 300 to 850 (with industry-specific scores from 250 to 900). Since 2013, VantageScores (3.0 and above) use the same 300-to-850 range, even if VantageScores were originally from 501 to 990.

The scoring models are created for use by a wide range of uses, such as credit cards and student loans. In addition, scoring models are updated from time-to-time to adapt to consumer behavioral changes, as well as use new technology and credit-related data.

Creditors choose which score to use and test different models to determine which is best to predict delinquency and manage risk with their customer base. The analysis of credit scores varies depending on the lender, but typically a FICO score of 670 (or a VantageScore of 700) is considered “good”.

FICO and VantageScore models are based on the information in credit reports when calculating a score.Credit scores are impacted by actions that we take; how much depends on a person’s credit profile and the particular scoring model, but both consider similar levels of significance to actions like paying a bill late.

Differences

If you check your VantageScore and FICO scores, you will find that they are not the same. This is partly due to different scoring models, and also the fact that the criteria are weighted differently in the models.

FICO scores are based on credit data from a single credit bureau: Experian, Equifax, or TransUnion; VantageScore combines information from all three bureaus. FICO requires a credit account with a history of at least six months and activity on any credit account during the last six months. A VantageScore may be created for a credit report with at least one credit account, regardless of the history.

There are a few categories that affect your credit score:

History: are payments made on-time or late, are accounts in collection, how long credit accounts have been open, defaults on loans, and bankruptcy.

Usage: the amount of available credit being used on revolving credit accounts, the amount owed on installment, experience with different types of credit.

Activity: new applications for credit that pull a credit report.

Scoring models weigh the specific pieces of information differently. For example, the utilization of credit is an important scoring factor; most scores consider recent usage of available credit. VantageScore now considers trended utilization which considers whether bills are paid in full or only minimum payments are made.

When a hard inquiry is added to a credit report, it may affect the credit score. Scoring models allow for multiple duplicate inquiries as this may be the customer shopping around. VantageScore allows a 14-day window for inquiries even if they are for different types of credit. FICO Scores now have a 45-day window, but widely used FICO models, such as those used for mortgages, still have a 14-day window. FICO only detects multiple duplicate inquiries for some types of credit. FICO also delays the impact of hard inquiries so that the credit score is not impacted until 30 days later.

Conclusion

While VantageScore and FICO scores have similarities, the underlying scoring models and methodologies have important differences. Of course, both scoring models are trying to predict the same thing: how likely it is that someone will be delinquent on a payment or default on a credit. According to studies, FICO scores are still used in more than 90% of credit decisions in the US, and low FICO scores are a dealbreaker with most lenders.

Appendix

Payment history (35%)

Whether an individual pays their credit accounts on time. Credit reports show the payments submitted for each line of credit, and the reports detail bankruptcy or collection items along with any late or missed payments.

Accounts owed (30%)

The amount of money an individual owes. FICO considers the ratio of money owed to the amount of credit available.

Length of credit history (15%)

The longer an individual has had credit, the better their score. FICO scores take into account how long the oldest account has been open, the age of the newest account, and the overall average.

Credit mix (10%)

The variety of accounts such as retail accounts, credit cards, loans, and mortgages.

New credit (10%)

Recently opened accounts.