May 10-11, 2023 | Javits Center, NYC

Fintech Nexus USA 2023 brought the great minds in the fintech industry together for two fast, jam-packed days of conversation and collaboration. Ripples of of recent macroeconomic trends continue to push the focus of today’s fintech ecosystem towards B2B. So, what were the key B2B fintech themes that surfaced this year?

Credit, Fraud, Compliance, Data, AI & More

A melting pot of both established leaders and tech-forward innovators found common ground through the rising needs and trends in the space. The most prevalent topics (and solutions) spanned from lending and credit, fraud prevention and identity management, compliance and regulatory, data aggregation, embedded finance, generative AI, and more.

Big players – Visa, MasterCard, Plaid, BHG Financial, Experian, Equifax, TransUnion, and many others – were booth neighbors to an expansive ecosystem of other lending and credit platforms, fraud prevention and identity management solutions, compliance and regulatory services, data aggregators, embedded finance API technology, and more.

Credit, Fraud, Compliance: All-In-One

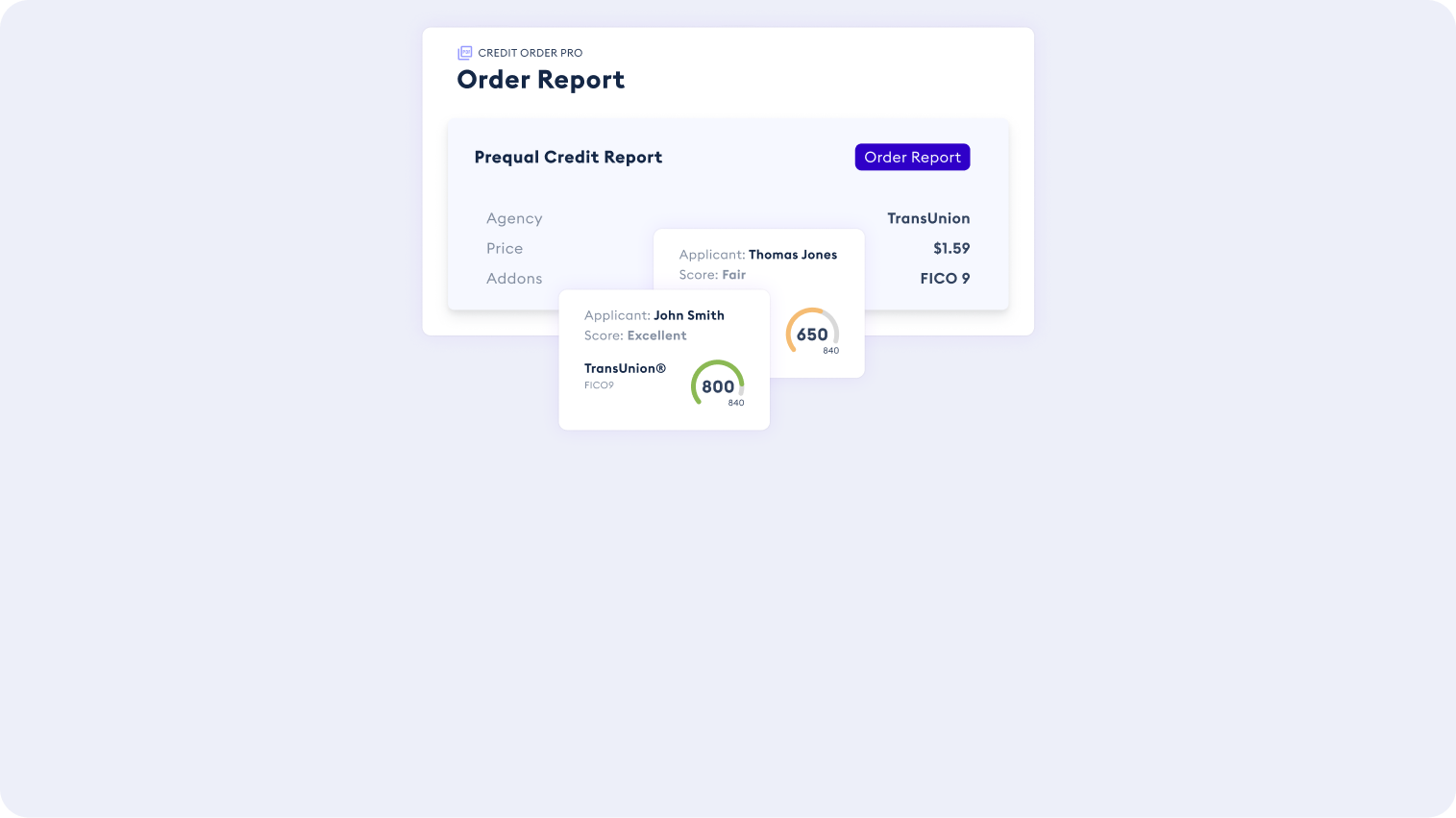

CRS was one of those neighbors, bringing our all-in-one credit, fraud, and compliance solution to the 2023 state of fintech. Unique to the industry, CRS brings all credit data and a growing rolodex of alternative data sources under one umbrella. As a CRA (Credit Reporting Agency), we bring something else to the table that not many data providers do (or could, even if they wanted to) – we have a certification from all three credit bureaus to act on their behalf. Yes, you read right, CRS can vet companies, offer guided compliance, and ultimately grant data access to those responsible, compliant companies in need of credit data and more to power financial flows and decisions.

We loved seeing customers and partners thrive in the scene as well – shout outs to Taktile, Oscilar, Persona, and, of course, our long-term, valued partners Equifax, Experian, TransUnion, and LexisNexis.

The Role of Data: Traditional Credit vs. Alternative Data

The conversation about the role of data – both traditional credit and alternative data – is all around us. How can businesses navigate the ever-changing state of accessible data to power their financial flows, pre-qualification processes, lending and underwriting operations, and decisioning engines?

Financial data is ever in flux and more businesses are looking to hybrid models that leverage traditional and alternative data – a broader data set for a growing and diverse customer base. In fact, our CEO & Co-Founder, Stephen Hawkins, spoke on this very topic: “Consumer-Permissioned Data vs. Traditional Data: Which is More Valuable Today?”