The pandemic’s impact on US businesses meant that bankruptcy filings increased dramatically in recent years. The number of business bankruptcies was anticipated to rise 196.0% in 2020 alone. However, many bankruptcy attorneys still struggle to find new clients.

Competition for leads is fierce, and many bankruptcy attorneys struggle to establish a strong online presence or effectively market their services. When bankruptcy attorneys don’t differentiate themselves from other competitors, potential clients will struggle to see why they should choose one attorney over another.

Likewise, many people are hesitant to file for bankruptcy because of the stigma attached to this sometimes necessary step. This stigma can make it difficult for bankruptcy attorneys to reach out to potential clients. It also limits the number of organic referrals that can be generated without a formal program.

Any attorney wondering how to get bankruptcy leads should start with some basic sales and marketing strategies. In this guide, we’ll break down some of the best methods for generating bankruptcy leads and simple marketing strategies to differentiate your practice and stand out to potential clients.

What are the best methods for generating bankruptcy leads?

The right marketing strategy for generating leads starts with a two-pronged approach known as inbound and outbound marketing.

Inbound marketing focuses on creating and distributing content that draws leads through your website. Outbound marketing refers to more proactive outreach. This involves sales strategies that can help you reach out to potential clients, nurture leads, and convert them into paying customers.

Before you set up the key tenets of your outbound sales strategy, we recommend getting your house in order first by improving your website, developing a target audience, and making it easy for clients to find you.

Marketing for bankruptcy attorneys: inbound sales tips

Make sure your website is prepared to convert leads into clients before you spend any of your marketing budget on lead generation.

Define your target audience

Before you reach out to potential new clients, start by defining your target audience. It’s important to know who you’re trying to reach with your marketing efforts. If you don’t know who your target audience is, you’ll be wasting your time and money on leads that are not likely to convert.

As you know, bankruptcy laws differ for businesses and individuals. For individuals, Chapter 13 bankruptcy may be a better option than Chapter 7, depending on the circumstances. When creating a marketing strategy, it is essential to identify your target client so that you can tailor your message to them.

Optimize your website

Your firm’s website should include key information about your bankruptcy practice and be user-friendly. Make sure that you provide basic details, such as your firm’s phone number, service area, services, and some bios of your key team members. Beyond this information, include reviews from former clients, FAQ pages so leads can learn more about your services, and lead links, such as “Get in touch for a free consultation.”

Pay attention to your website’s performance, too. Optimizing for elements like high page loading speed, smooth navigation, readability, and mobile-friendly design, as well as clarity around your messaging can help Google and other search engines index your site properly. Use keywords to help boost your organic search ranking.

Be active online

To increase your visibility and differentiate your firm from others, consider posting regularly on social media and other sites. Create a Google Business Profile to help manage and optimize your presence on Maps and other Google sites. Get listed in legal directories such as Nolo, Find Law, Legal Zoom, Justia, and more. Post in LinkedIn groups and other networking sites to show thought leadership and extend your reach to potential clients. And, make sure there are many calls to action on your website where a client can get in touch.

Bankruptcy attorney marketing: outreach and referral tips

Once you have an online presence and an optimized website, you can begin the outreach portion of your bankruptcy attorney marketing campaign.

Create a nurture strategy

Not all leads are ready to become clients immediately. It’s essential to have a lead nurturing strategy in place, which may involve regular communication, sharing educational content, or offering free resources to build trust and maintain engagement with leads over time. Create a lead nurture strategy to make the most of every outreach effort.

Foster referrals

Building relationships with other attorneys, professionals, or organizations who can refer potential clients can be a valuable source of leads. It may not be ethical to incentivize referrals — while legal in the strictest sense, you may run against client confidentiality best practices — but you can get involved with the community to build goodwill and generate leads. Partnering with other businesses is another great way to reach a new audience.

Offer free consultations

Any lead capture mechanisms, such as contact forms, email subscriptions, or call-to-action buttons should direct to a free consultation with you or someone from your team. Offering free consultations is a great way to foster leads and build trust with potential clients. When you offer a free consultation, be sure to explain the bankruptcy process in detail and answer any questions that the client may have.

A free consultation also gives you a chance to vet if the lead is the right fit for your firm.

What makes a good bankruptcy lead?

For some, any lead is a good lead. But, as you build up your bankruptcy attorney marketing strategy, you’ll start to receive more potential clients than you can take on. Discerning which leads are worth pursuing is part of the process of building this area of your business.

Good bankruptcy leads typically possess certain characteristics that indicate a higher likelihood of becoming a potential client. While the specific preferences may vary among attorneys, there are some common qualities that most firms can look for when evaluating potential clients.

First, look for someone who genuinely needs your assistance. Look for a lead who may be facing overwhelming debt, foreclosure, wage garnishment, or other financial difficulties that make bankruptcy a viable solution. A good bankruptcy lead will be able to provide clear information about their financial situation, such as details about their debts, income, assets, and any relevant legal issues.

In addition, look for someone who is realistic and open to the process. Good potential bankruptcy leads understand the potential outcomes and limitations of the bankruptcy process and are willing to engage in a consultation with you to discuss their situation and explore potential solutions.

Finally, the best potential bankruptcy client leads are those who can help you grow your business. They should be able to afford attorney fees and associated costs related to the bankruptcy process. And, a lead who may be able to refer other individuals or businesses who are also in need of bankruptcy services is extremely valuable.

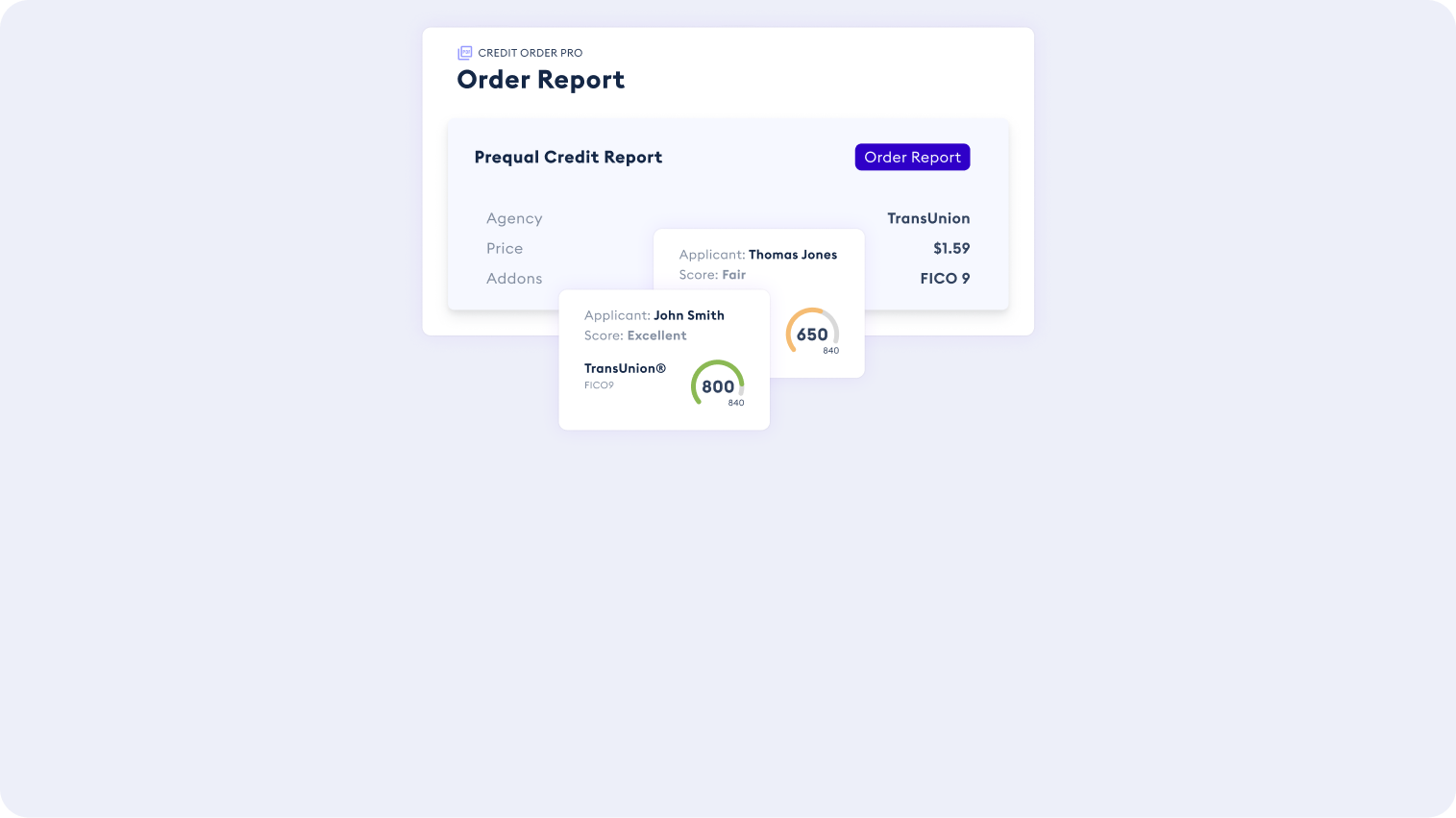

How CRS Credit can help you vet bankruptcy leads

Not every bankruptcy lead will be the right fit for your practice. Credit Reporting Services allows you to easily and efficiently access the credit data you need on debtors and bankruptcy clients directly into your platform.

CRS Credit can help you take time back from performing manual credit checks. Whether you’re representing a creditor or a debtor, obtaining reliable credit data can be tedious and time-consuming. With automated credit checks, you’ll reduce the time you spend getting your hands on reliable credit data, and spend less time drafting bankruptcy documents.

Our user-friendly and easy-to-integrate products offer you instant access to accurate bankruptcy credit reports so that you can dedicate your focus to guiding your clients through the bankruptcy process. By providing a great client experience, you’ll be able to ask for positive reviews, create a pipeline of high-value referrals, and grow your practice effectively. Learn more about our products for bankruptcy attorneys by getting in touch with us today.