Integrating Credit Reporting Services Into My Property Management Software

March 23, 2022

As a property manager, it is incredibly beneficial to access potential tenants’ credit reports when going through the screening process. Tenant screening, a necessary part of any property manager’s application process, keeps you informed about each potential tenant’s eligibility for renting your property. The tenant screening process typically includes a credit check, which assesses the prospective renter’s credit score, as well as an assessment of any debt present on the potential tenant’s record–both critical pieces of information to help you as a property manager make the best informed decision to benefit your business.

3 Reasons to Use Credit Reporting Software for Tenant Screening

1. Credit Checks Made Easy

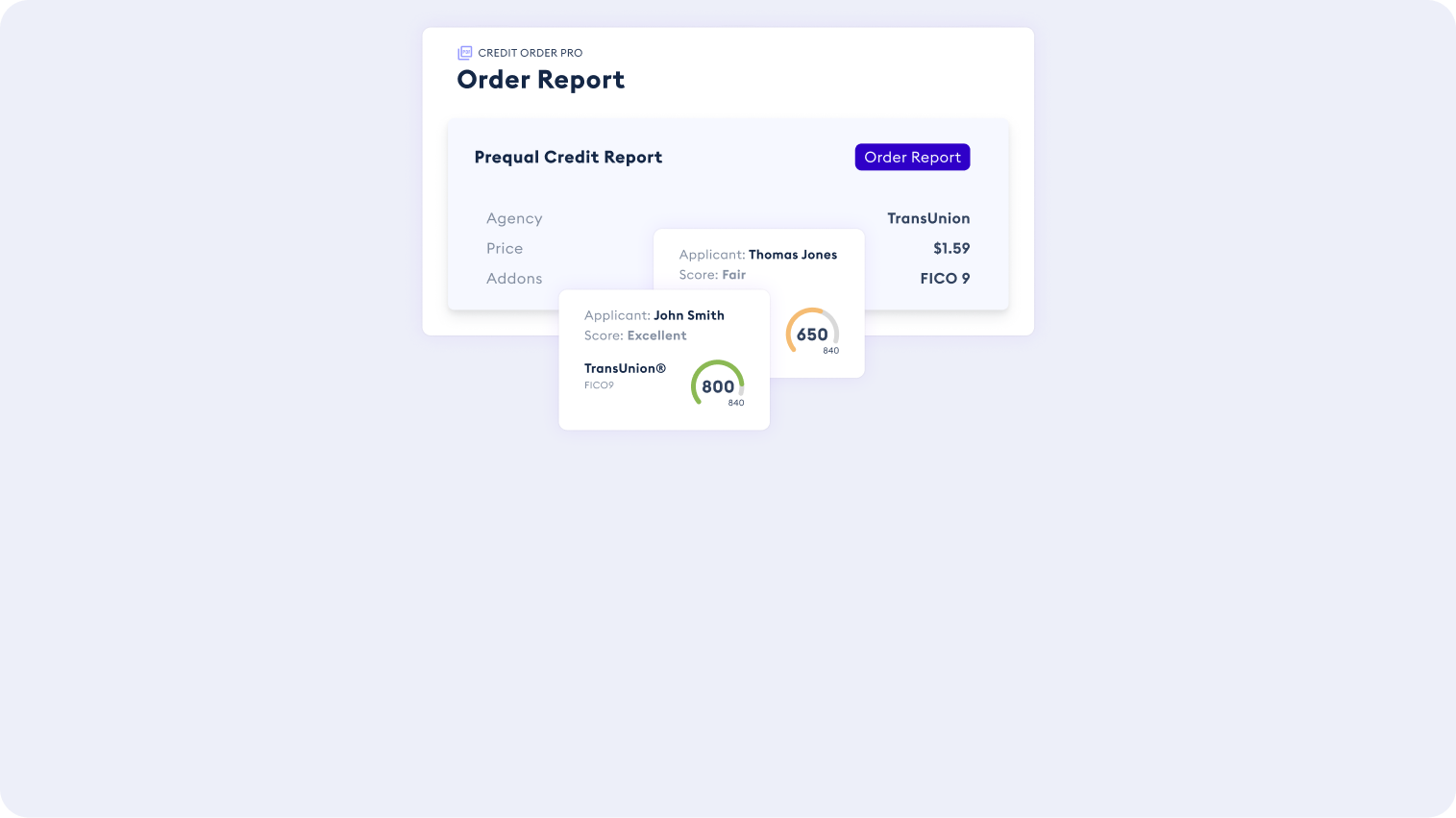

Tenant screening involves credit checks, which are made easy with the use of credit reporting APIs. Using APIs for credit checks allows you to easily access potential tenants’ credit data. Having an accurate representation of every prospective renter’s credit data is essential to the tenant screening process, and using reliable credit reporting software makes this possible by allowing you to perform a soft-pull credit report from Equifax and hard inquiry reports from the other two bureaus from within your property management software or CRM (customer relationship management) program.

2. Background Checks Simplified

Credit reporting software is extremely useful for property managers because it grants access to useful background check information, too. Through credit API services, you as a property manager can check renter’s criminal records. This gives you peace of mind about anyone renting from you, ensuring that you have comprehensive knowledge of each renter’s reputation.

In addition, credit reporting software can be used to check on prior renting history such as Eviction Reports. This gives you a sense of a renter’s reliability, as well as their commitment to previous rentals, helping you to make a confident, informed decision about gauging their eligibility and capability to rent from you. This information is included in the client’s credit report for easy access.

3. Perform Multiple Functions Quickly

As a property manager, it is essential to have a tenant screening process that is expedient and efficient. Instead of outsourcing credit and background checks which can expend extra time and energy, you can instead integrate a credit reporting API into your property management software or CRM.

Using credit reporting software for tenant screening means you have access to everything you need to get the job done all in one place. It’s the smartest, most convenient way to make decisions with confidence as a property manager.

Using Credit Reporting Software for Property Management: Where to Begin

It’s easy to wonder where to start with integrating a new piece of software into your work. If you already use Zoho CRM, you’re in luck. Credit reporting software can be added to your CRM with ease as a Zoho plugin. Integrating credit API services with your CRM means you will be able to access credit data from within the same program you already use for the rest of your responsibilities as a property manager.

A CRM is incredibly helpful for property managers, allowing for easy access to lead tracking and other helpful day to day operations. A property management CRM can even be programmed to automatically send emails to potential applicants.

Adding a credit API to your CRM can be done with custom specifications to accommodate the software you use. The length of this process can depend on what software you use, but integrating a credit API with your CRM is worth the effort. It turns your CRM into a multi-purpose program for background checking, lead tracking, obtaining credit data, and more.

Credit APIs can also be used to track leads by providing access to lists of potential renters. This helps you as a property manager to know how to best market your property to potential renters by using data pulled by a credit API.

Covering the Prerequisites

Obtaining credit data from potential tenants requires the use of credit reporting software, which can be used independently or integrated with property management software or your CRM. However, there are a few prerequisites to make sure you have covered before you get started.

If you are starting out without a CRM, you can still integrate credit API services into your workspace. One of the first steps to take is ensuring that you have a permissible purpose to collect credit data. As a property manager, this is essential.

In order to compliantly collect credit reports from potential tenants, you must first have what is known as a permissible purpose to pull credit data. Permissible purpose is defined as the reason for pulling consumer credit data for use in screening investors, clients, renters, and others, based on the nature of your business.

Obtaining approval from the big three credit bureaus – Experian, Transunion and Equifax – is a key aspect of integrating credit reporting software into your workspace as a property manager. A big advantage of going through CRS is that you get access to all three credit bureaus with just one vetting process rather than having to get vetted by all three individually. There is no one specific bureau that is more reliable than the others. Credit reporting software gives you access to credit data from all three, giving property managers the ability to cross-reference credit reports to get the most accurate picture of the credit history and health.

In addition, each potential tenant must give you permission to run a credit check on them. Obtaining the prospective renter’s consent keeps your screening process compliant and keeps everything above board.

Integrating the Software

The integration process for credit reporting software depends on your current setup as a property manager.

If you are looking for a standalone program to run credit and background checks, a web-based credit API can be useful. A web-based credit API gives you access to credit reports, identity verification, background checking resources, and fraud detection without the use of a CRM or property management software.

If your goal is to integrate credit reporting software with the CRM or property management software you already use, you can do so through a custom setup. This integrates a credit API with the program you currently use, allowing you to use both property management and CRM features in tandem with credit reporting software.

Running Credit Checks and Making Decisions

Using credit reporting software to run a credit check involves interacting with a potential tenant and obtaining their consent. A prospective renter will fill out a form giving you the information necessary to run a background check and a credit check. With the potential tenant’s approval, you then can run checks. Some property managers will charge applicants a credit check fee. This allows the property manager to run a credit check without paying out of pocket to credit bureaus.

While all three credit bureaus can be accessed via an API, it requires significant effort in vetting and integration costs from each bureau. With CRS, all three products are integrated together into one vetting process.

If you are using a credit API in tandem with your CRM, you can use your CRM to send auto-generated responses to potential tenants after assessing their credit reports. This expedites the process of tenant screening and you more time to focus on other work.

Implementing New Features

Credit APIs can be equipped with a multitude of features to help you accomplish your specific goals.

If your aim is to use credit reporting software to build up your marketing strategy as a property manager, these specific tools can come in handy. It can be immensely helpful to add features to your CRM that allow you to pre-screen potential renters to check if they qualify for certain properties, and then automatically reach out to them if they do, further streamlining your day to day operations for a more efficient, productive way of doing things.

Making the Most of APIs

One of the best ways to integrate credit reporting software into your property management strategy is to keep improving your use of credit APIs. As you grow your business, look for new opportunities to make use of what credit reporting software has to offer.

Because there are multiple uses for credit APIs in property management, it is easy to use them without reaching their full potential in your work. Aim to get to a point where your use of credit reporting software as a property manager is beneficial for tenant screening, marketing and advertising, and managing the data of current renters.

As you continue to acquire new tenants, make use of credit reporting software to avoid rent defaults. Performing extensive background checks and obtaining credit data will give you the chance to gain a comprehensive assessment of each potential tenant before making a decision. This process is worth taking seriously, as you do not want to make the wrong decision and end up with an unreliable tenant. Thankfully, CRS can give you the information you need to accurately assess every potential tenant.

Make the most of your credit API by familiarizing yourself with each of its uses and features. This will ensure that you are using the software to its fullest potential to increase your productivity, efficiency and profit!