The pandemic created an opportunity in the consumer lending market, according to research by McKinsey Consulting. The firm’s analysis revealed that although financial institutions are serving a significant share of the consumer population, there are large segments that are underserved or not served at all.

“New-to-market lenders can identify the gaps in lending coverage and try to bridge them,” wrote McKinsey. “New entrants can design new offerings quickly and are unencumbered by legacy processes or infrastructure. They can move from concept to fully developed offering in two or three months, compared with one to two years for incumbents.”

This new competitive landscape means both traditional and nontraditional lenders will need the right technology to establish or maintain a strong position. Consumer lending software can provide a significant advantage, streamlining and automating tasks to make the loan approval process faster, smoother, and more efficient for both lenders and borrowers.

Here’s what to know about consumer lending software, including the most popular and best consumer lending software to consider.

What is consumer lending software?

First, let’s review the basics: Consumer lending software is a comprehensive platform designed to manage the entire lifecycle of consumer loans, from initial inquiry to repayment and everything in between.

This category of tools is used by a wide range of lenders, including banks, credit unions, online lenders, and fintech companies. Consumer lending software handles loan origination (including application processing, credit checks, underwriting, and approvals), document management, account management (such as tracking payments and late fees), reporting, and compliance.

Consumer lending software and loan origination software are two terms that are often used interchangeably. However, loan origination software is designed to focus on the initial stages: streamlining the application and approval process for loans. It is mainly used by traditional banks and credit unions.

Ultimately, both consumer lending software and loan origination software can handle streamlining loan approvals. Choosing the right solution depends on whether you want additional features or not. If you do, then a broader consumer lending software option might be your best choice.

5 Best consumer lending & loan origination software

This list will include both the best consumer lending software and loan origination software options, with a focus on finding a tool that streamlines loan approvals. Consider these options as you assess and vet potential additions to your consumer lending tech stack.

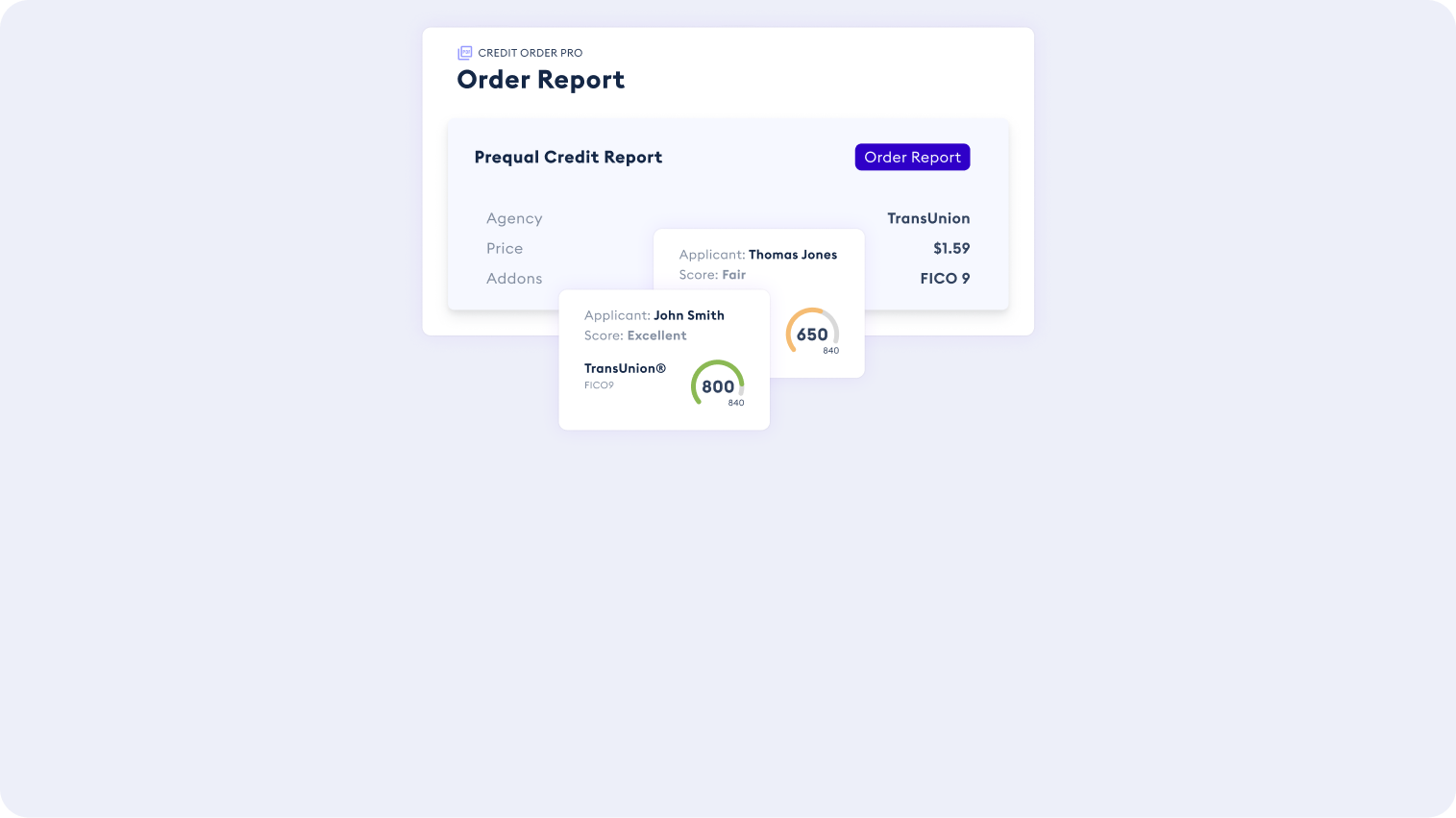

CRS Credit API

CRS offers a Credit API that gives you efficient access to reliable credit data and enterprise-level support to make better consumer lending decisions. As the leading independent credit data API, it provides a way to access all-in-one credit data solutions in a fraction of the time. Get a plug-and-play widget for direct-to-consumer credit reports and monitoring that is easy to use and completely compliant. CRS’ Credit API integrates with platforms your team is already using to make the approval process more efficient with better data.

[Read more: CRS credit data API is the fastest way to get credit data for your business]

Abrigo

Abrigo is a software suite that includes loan origination, document management, and workflow management capabilities, making it a compelling consumer lending software option for financial institutions. Abrigo is primarily focused on risk management, helping lenders identify risks in the consumer lending process to make better business decisions.

LoanPro

LoanPro focuses on helping its users manage their loan portfolios. This cloud-native software allows users to manage unlimited loan programs within a single environment, making it possible to build and manage consumer loan programs from origination to line of credit. As one LoanPro user review states, LoanPro is a “Highly flexible and customized solution for any lending partner; including anything from applications to servicing, and consumer loans to SBA loan servicing.”

Turnkey Lender

Turnkey Lender is a cloud-based solution that provides a comprehensive suite of features for managing the entire loan lifecycle. This award-winning software uses AI to automate 90% of the lending process, streamlining consumer loan approvals as well as SME financing, grant management, money lending, and more. One Turnkey reviewer says, “The interface is easy to use for us and for consumers. The platform easily integrates with multiple payment processing and electronic signature companies.”

Nortridge

Nortridge offers a loan origination system that is designed for credit unions and used by a range of different institutions. Core components of this consumer lending software include servicing, collections, and customer relationship management (CRM). Tailor this platform to handle auto, payday loans, peer-to-peer lending, or medical loan servicing. Nortridge reviewers say this platform is highly customizable, although it can be pricey.

Benefits of consumer lending software

While implementing consumer lending software requires an initial investment of time and resources, the long-term efficiency, accuracy, and risk management these tools provide can significantly improve a lender’s bottom line.

Some of the best consumer lending software can automate repetitive tasks like document collection, credit checks, and underwriting, which free up staff time for more complex tasks. It offers an overall better customer experience by guiding borrowers through the loan process with clear instructions, eliminating unnecessary steps, and reducing processing time and delays. Plus, automated notifications and updates keep everyone informed throughout the process.

For lenders, these tools also improve decision-making. Modern consumer lending software and loan origination software use advanced algorithms to analyze data and make faster, more informed lending decisions based on objective criteria. CRS, for example, accesses data from various bureaus to ensure lenders have all the information they need to determine a consumer’s eligibility.

Finally, consumer lending software can help lenders stay on the right side of compliance regulations. These tools are built to adhere to complex regulations and lending standards, ensuring accurate loan terms and fair treatment of borrowers.

Elevate Your Consumer Lending Process with CRS

CRS is built to handle the most challenging credit data requirements. Our industry-leading credit data API releases your team from expensive, tedious, and manual data pulls that bog down the consumer lending process. We follow all consumer lending best practices to make sure you’re equipped to achieve positive returns as soon as possible.

CRS works with businesses of all sizes, eliminating costly barriers to entry. Learn more about our consumer lending API by reaching out to our sales team today.