According to a 2022 survey, US companies are losing an average of $300,000 per business annually to fraudulent invoices. Choosing the wrong business partner or customer is a costly mistake, and not just in terms of dollars. Companies risk damaging their brand reputation, losing customers, and running into legal issues.

Fortunately, there are ways to mitigate risk when extending financing or delivering services. Just like individuals, businesses get a credit score rating that indicates the level of risk associated with lending money to a company. A business credit report is calculated slightly differently from an individual credit score. And, learning how to check a business credit score can help ensure your business benefits from reliable partnerships that won’t take advantage of or damage your business.

What is a business credit report?

The goal of a business credit score is to indicate to credit agencies, loan issuers, and other businesses an idea of how trustworthy a business is when it comes to borrowing money.

Business credit scores are determined by information from a business credit report, which considers factors such as:

- Business longevity: The longer you are in business, the better for your credit.

- Revenue: If you are bringing in revenue, it may have a positive impact on your business credit.

- Assets: Real estate and other high-value assets could raise your business credit score.

- Outstanding debts: Paying off loans and credit cards on time will help build your business credit.

- Industry risk: Some businesses, like bars and restaurants, are seen as riskier than others and can cause lenders to assess their credit differently.

- Personal and business loan and credit history: In particular, your personal credit score can impact your business credit, especially if you are a new business. “If you have some history that indicates your likelihood to pay back loans in the future, this can affect your score, as well as make you more attractive to lenders,” wrote Fundbox.

Business credit reports also consider factors such as the number of employees a business has, historical data of the business, account information, and more.

Business credit scores don’t fall on the same scale as personal credit scores. Most business credit scores use a scale ranging from 0 – 100, although the FICO Small Business Scoring Service (FICO SBSS) ranges from 0 to 300.

What are the different business credit report agencies?

The Fair Credit Reporting Act (FCRA) makes personal credit scores private; but, this protection does not extend to business credit reports. Anyone has the option to pull a business credit report without the organization’s permission.

There are three main agencies that you can use to check another business’ credit score.

- Dun & Bradstreet: Known as the PAYDEX score, this credit report ranges from 0 to 100, with 0 to 49 scores being the highest risk. When you order a business credit report from Dun & Bradstreet, you’ll get a credit summary, a credit risk score, and a financial stress score, as well as payment comparisons between the business you’re researching and other companies in the industry.

- Equifax: This package comes with a business credit report; a credit risk score that predicts the likelihood of a partner becoming 90+ days delinquent; a business failure score that predicts the likelihood that a business will fail while owing a debt to creditors within the next year; and, a payment index that quantifies a business’ payment habits.

- Experian: Known as the Intelliscore Plus, this business credit report has different options depending on your needed information. “You can see your business credit report for as little as $39.95, but you can pay for an annual plan that lets you monitor your business credit reports and score for $189 per year,” wrote Bankrate.

What about SBSS?

A fourth option is FICO’s SBSS or Small Business Scoring Service. Only lenders who are FICO customers can access this business credit report. Given the popularity of the FICO credit scoring model, though, this is an option for many lenders. The scoring model used in SBSS draws on information from Experian, Dun & Bradstreet, and Equifax. The SBSS score is typically used by the Small Business Administration (SBA) to assess applicants for small business loans.

How to check a business credit score

It’s relatively easy to check a business’ credit report, but it can be expensive.

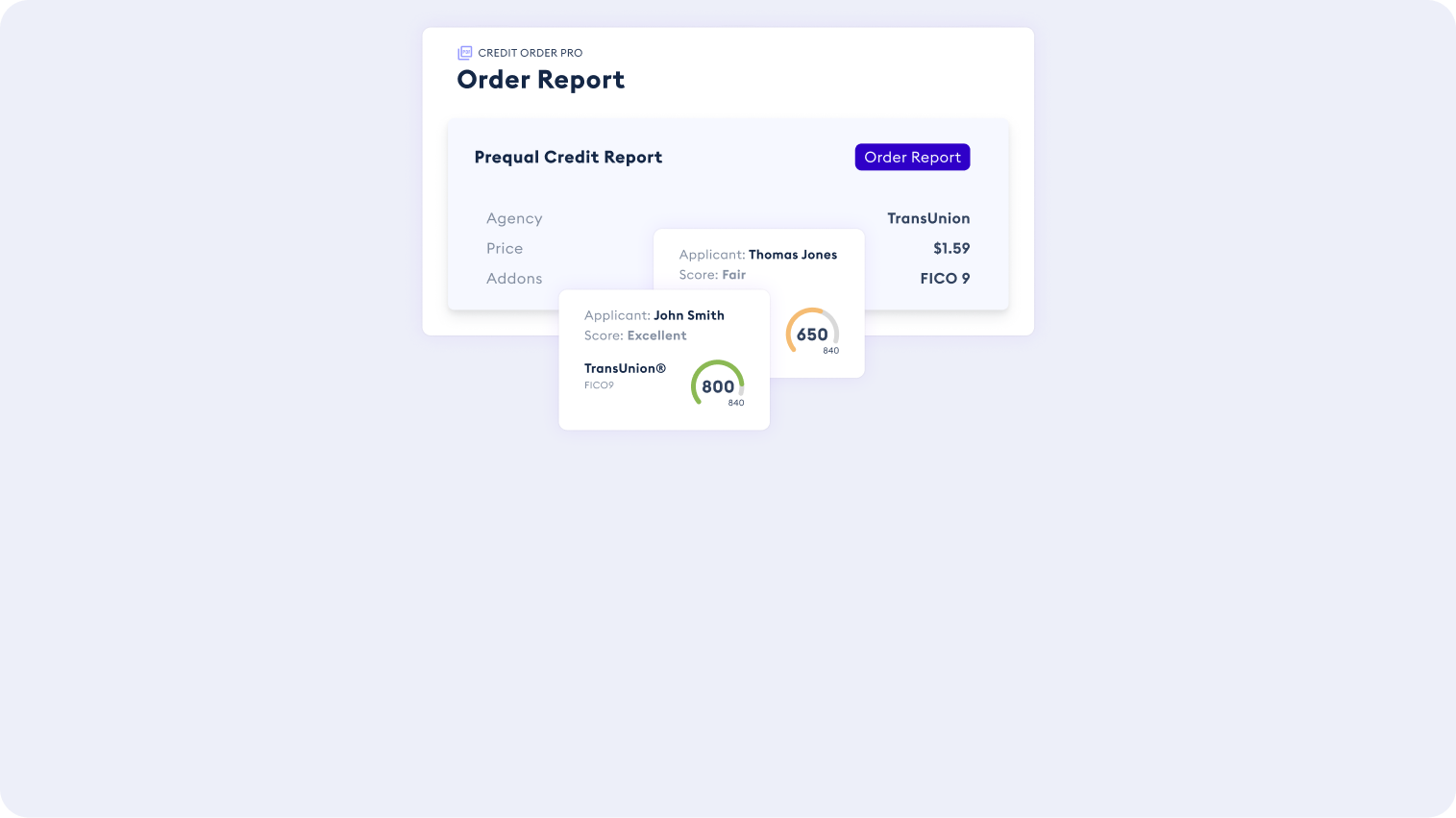

There are many ways to check a business credit report. Enterprises can go directly to one of the agencies listed above to engage their sales teams. Simply go to their website, follow the steps to create an account, and submit the required information. The agency may ask you for the business’s DUNS number or Tax ID number to get the report. However, not all businesses can satisfy the financial requirements of working with these agencies, like monthly minimums and upfront fees. This is where CRS comes in, enabling companies of all sizes and across industries to access business credit scores, reports, and other data affordably and efficiently. In fact, many CRS customers have saved months with guided compliance on the CRS platform.

To check the business credit report, choose one of the agencies listed above, go to their website, and follow the steps to create an account and submit the required information. The agency may ask you for the business’s DUNS number or Tax ID number to get the report.

Keep in mind, these credit reports can be costly. According to Fundera, here’s what you can expect to pay per business credit report.

- Dun & Bradstreet: $121.99 for a one-time credit report

- Equifax: $99.95 for a one-time credit report

- Experian: $39.95 for a one-time credit report or $189 per year.

Of course, pricing can depend on the volume of credit reports you pull and the package and partner you choose.

Once you get the business credit report, you’ll need to make a decision about whether or not to work with a potential customer. A good business credit score is considered anything higher than 76 for Equifax or Experian, 80 from Dun & Bradstreet, or 160 from FICO SBSS, which is the minimum for SBA loans.

A low credit score could indicate that there’s something shady about a business. These business credit reports provide objective insight into debt repayment, credit utilization, bankruptcies, and more.

A low score doesn’t automatically mean you shouldn’t work with a business; but, it does mean you should ask for more information. A low score could be the result of a new business that doesn’t have a sufficient credit history yet. Or, it could be the result of actions by one bad apple who’s since left the company. You may use this information to decide what invoice terms (e.g., net 30, 60, or 90), if any, you will extend.

How to monitor business credit reports

In general, it’s a good idea to monitor the business credit reports of all your customers and partners to watch for any red flags that could impact your company’s reputation. Beyond checking the credit report of any new partners before you do business with them, you should also check scores annually or quarterly.

If you are working with a business that has a history of financial problems, you may want to check their credit score more often. This will help you to stay ahead of any potential problems and to protect your business.

Applying for business credit reports can get expensive quickly. That’s why choosing the right credit industry partner for your business is crucial. Whether you’re looking to replace a current business credit solution or a scaling business still learning the ropes, CRS is here to guide you to success. We offer technology that makes our customers’ lives easier, best-in-industry customer service, and decades of industry expertise.

Our industry-leading credit data API provides reliable access to credit data – both consumer and business credit reports, in fact. With direct connections to all major bureaus – Equifax®, Experian®, TransUnion® – and vendors of public and private financial data, we help our customers get any combination of data they need and stay compliant while doing it. CRS’ business credit reports can help mitigate the risk of working with the wrong business, while providing the data you need to make better business decisions.