Historically, lenders have been wary about providing credit to small businesses in the US. A report by the US Federal Reserve details that lending to small businesses is generally considered to be riskier and more costly than lending to larger firms.

“The failure rate in the early years of a business—when the firm is likely to be the smallest—is quite high relative to later years. Additionally, smaller firms fail at a higher rate than larger firms,” wrote the Federal Reserve Board.

However, small businesses consistently need funding to get off the ground. The most recent Annual Business Survey, conducted in 2021, found that 15% of businesses formally applied for new credit in 2020, excluding applications to pandemic-related loans. The small business loan industry serving these entrepreneurs meets a diverse range of needs, from business expansion to equipment purchases to marketing and advertising.

There are 33.2 million small businesses employing more than 61.5 million people in the US. Yet, only 42% of small businesses have their financing needs met. The small business credit market presents an intriguing opportunity for lenders who are equipped to manage their risk. Lenders who stay informed about small business loan statistics and trends can make better decisions about how to allocate their resources, how to develop new products and services, and how to manage their risk exposure.

Key small business lending statistics

Small business lending statistics help members of the small business loan industry. Commercial banks, credit unions, financial institutions, and online lenders are able to adjust lending strategies, invest in data analysis tools, and tailor financial offers to meet the evolving needs of small businesses. This data can also help manage risk and make better, data-driven decisions.

Small business loan applications

According to the latest Federal Reserve report, the average small business loan amount is approximately $663,000. Only 34% of small businesses applied for a loan in 2021, a decrease from 43% of small business loan applications in 2019.

“The reason for the decline in traditional financing is unknown. However, it indicates that small businesses are picking alternative financing options, such as crowdfunding, peer-to-peer lending and fintech platforms,” wrote Nasdaq.

Of these loan applications, only 31% of small businesses received the total amount for which they applied.

Why do small businesses need loans?

Small business owners apply for loans for a wide range of reasons. Surveys from the US Census Bureau identified a few common reasons, but there are a diverse group of entrepreneurs starting businesses—21.4% of businesses are owned by women and nearly 20% of SMBs are minority-owned.

According to the census, the top reasons to apply for a business loan are:

- To meet operating expenses

- To expand the business, pursue a new opportunity, or acquire business assets

- To replace capital assets or make repairs

- To refinance or pay down debt; or

- Something else.

Other reasons for requesting a loan include business franchising, startup costs, payroll financing, and inventory purchases. Ultimately, the purpose of their loan request has a lot to do with whether the SMB owner is able to secure financing.

“Businesses that were less often approved for the full amount of credit for which they applied more often reported that the purpose of seeking credit was to meet operating expenses,” wrote the Federal Reserve. “For instance, 62% of female-owned businesses planned to use credit to meet operating expenses compared with 55% of male-owned businesses, while 72% of Black- and African American–owned businesses sought credit to meet operating expenses compared with 54% of white-owned businesses.”

Small business loan approvals

Alternative lenders had the highest loan approval rates as of March 2024, accepting over 28% of small business loan applications in the United States. Big banks had the lowest acceptance rates.

Loan approval rates vary by industry, too. For example, the biggest share of 2022 SBA 7(a) loans to small business owners went to those in the hospitality industry (restaurants and hotels), followed by retailers and healthcare providers. These sectors had the highest demand, but it also demonstrates that many small businesses need tailored loan programs to meet their needs.

Existing and emerging small business lending trends for 2024

Since the pandemic, there’s been a higher demand for goods and services—so much so that many small businesses are struggling to keep up without an injection of funding. Changing regulations and an unpredictable economy are also directly impacting small businesses (and, in turn, the small business loan industry).

On a macro level, inflation, lingering supply chain issues, and higher interest rates are increasing pressure on small businesses. Inflation reached 8.5% in 2022—the highest it’s been since the early 1980s. In response, the Federal Reserve has increased interest rates. The average small business bank loan interest rate ranged from 5.75% to 11.91% in the second quarter of 2024.

Inflation and interest rates don’t just impact small businesses; banks are also experiencing these trends. As a result, loans from banks are getting harder to qualify for. “Banks tightened their lending standards for businesses and households in the second quarter and expect that to continue for the rest of 2024,” reported Yahoo Finance. Uncertainty about the economy, concerns about bank funding costs, and worsening credit quality in their loan portfolios are all causes for banks to pull back.

Changes by the federal government have also led to discouraging small business lending trends for 2024. “Government programs kept many small businesses alive during the pandemic. However, the Paycheck Protection Program and Employee Retention Credit are no longer accepting applications at this time,” wrote the US Chamber of Commerce. Less government funding will lead to increased demand for loans from the private sector.

Mitigating risk in the small business loan industry

What’s next for the small business loan industry? There are two notable regulatory changes that are intended to positively impact small business lending in the near future.

The SBA implemented a number of updates to its loan programs in August 2024. These updates aim to expand access to capital for small businesses, especially those in underserved communities. These changes allow new, nonbank lenders to offer SBA 7(a) loans, update restrictive lending criteria, and simplify the underwriting process for small loans.

Additionally, the Consumer Financial Protection Bureau (CFPB) finalized a rule in April 2024 requiring lenders to collect and report demographic data for all small-business loan applicants. This data includes ethnicity, race, and sex, as well as minority-, woman-, or LGBTQ+-owned business status. The rule is intended to expose gaps in capital access and will apply to a range of lenders, including banks, credit unions, and nondepository lending institutions.

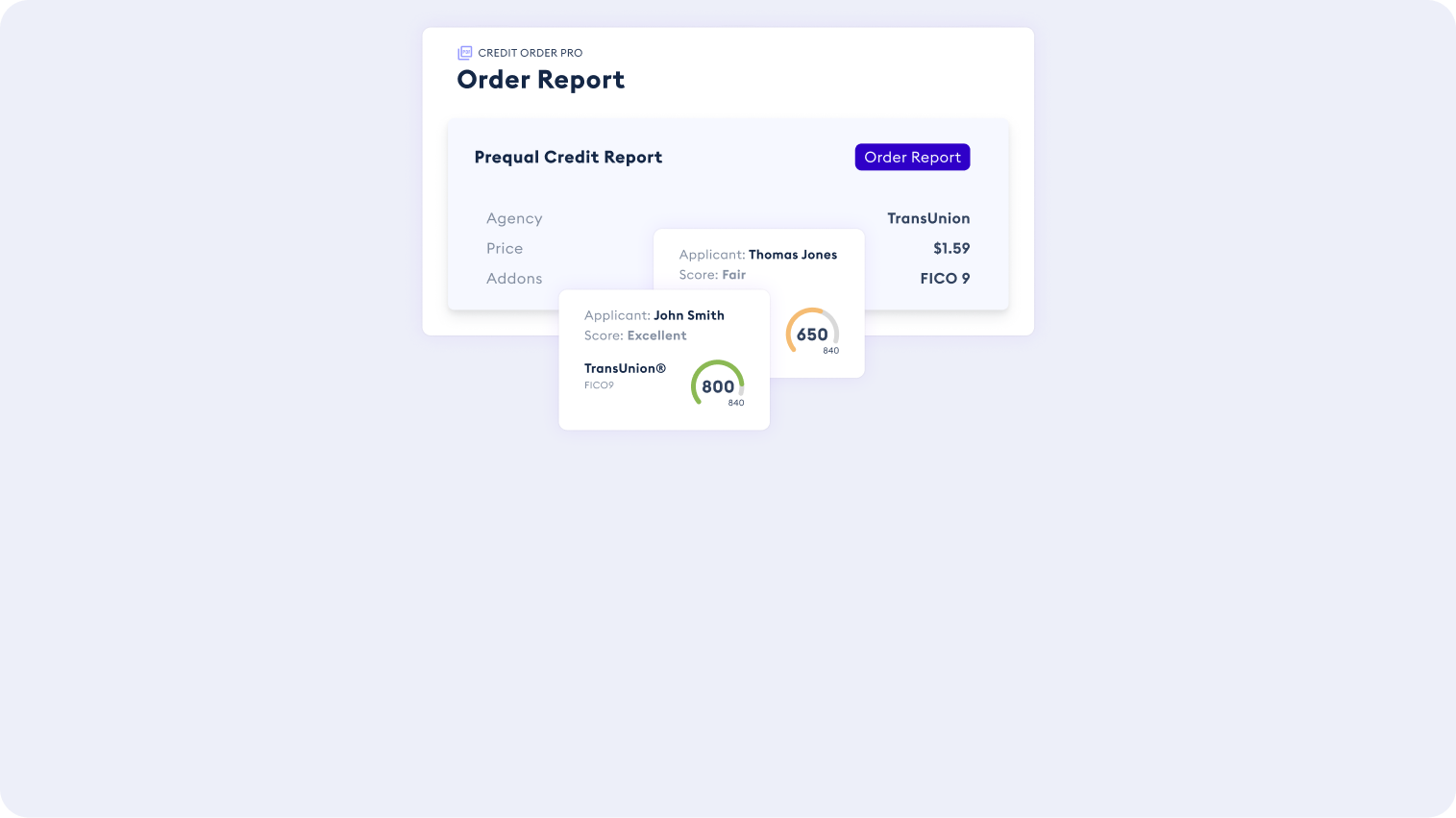

There are also dozens of companies working to help financial institutions and nontraditional mitigate risk when reviewing small business loan applications. CRS, for instance, offers credit reports that help lenders make smarter, data-driven decisions around business loans.

CRS enables companies of all sizes and across industries to access business credit scores, reports, and other data affordably and efficiently. Our industry-leading credit data API provides reliable access to credit data, including FICO’s SBSS score. With direct connections to all major bureaus—Equifax®, Experian®, TransUnion®—and vendors of public and private financial data, we help our customers get any combination of data they need and stay compliant while doing it.

CRS’ business credit reports can help mitigate the risk of working with small businesses while providing the data you need to make better business decisions. Learn more about our all-in-one credit, fraud, and compliance platform.