Tenant screening is one of the most important processes in successful property management. A thorough tenant screening process ensures the selection of responsible and reliable tenants while minimizing financial and property risks.

Understanding your tenant’s profile is more important than ever, as a recent Princeton study cited in USA Today highlights that evictions are at their highest rate ever.

But the reality is that tenant screening can be as complex as it is essential, encompassing various checks and balances, from credit and background checks to eviction history reviews.

In this comprehensive guide, we’ll walk you through the tenant screening process, covering all its essential steps and offering expert insights for optimal results. We’ll also demonstrate how you can utilize the CRS platform as an innovative, full-suite solution that simplifies this complicated process. CRS provides easy access to credit reports, criminal records, and eviction data through a single, trusted credit data API.

Understanding the Tenant Screening Process

Tenant screening is a multifaceted procedure aimed at verifying the reliability and suitability of prospective tenants. It begins with gathering basic information through a rental application and progresses to more detailed checks. This process is vital in mitigating the risks of property damage, ensuring timely rent payments, and maintaining a secure environment for all residents.

Compliance Considerations

Before you start the tenant screening process, it’s important to recognize that both tenants and landlords are subject to housing regulations that impact how you do business. Landlords are subject to these laws whether or not they know about them so it’s better to be prepared rather than risk a lawsuit.

At the federal level, tenant screening is covered under the Fair Housing Act (FHA)

administered by the Department of Housing and Urban Development (HUD). The FHA is in place to prevent discrimination in housing decisions, protecting the rights of applicants and tenants to make sure they are fairly considered for lease agreements.

There are six “protected classes” listed under the FHA, meaning you may not make housing unavailable to persons because of race or color, religion, sex, national origin, familial status, or disability.

In short, the Fair Housing Act prohibits landlords from gathering and using information related to these characteristics as a basis for selecting a tenant (HUD offers a comprehensive list of illegal activities under federal fair housing laws, which you may check if you need more guidance.).

There are also state and local fair housing laws with which landlords need to comply during the tenant screening process. Most states have a dedicated fair housing agency responsible for enforcing state fair housing laws. You can find the contact information and resources for your state’s agency by visiting the HUD Directory of Fair Housing Organizations.

Start with these regulations before diving into the tenant screening process to avoid any activities that can put your business in legal jeopardy.

Tenant Screening Checklist

Make sure your tenant screening is as comprehensive as possible to mitigate the risk of late payments in the future. This tenant screening checklist can help ensure you’re covering all your bases while still offering a great experience for potential new tenants.

1. Create a list of minimum application requirements

The first step in the tenant screening process is to be clear about the property you are offering and the desired tenant profile. Write a profile of the property, including the deposit, lease amount, accessibility, and other information. Then, ask potential applicants to fill out a pre-screen questionnaire. This survey can ask for information about income, credit score, pets, smoking habits, and move-in date to quickly eliminate unqualified applicants.

2. Collect full applications

Invite those who qualify to submit a full rental application, which includes information needed to conduct a tenant screening credit report. This application should be standardized and ask about the applicant’s employment, references, and rental history. Require copies of government-issued ID and proof of income.

Note that to run a credit check, you need explicit permission from the potential tenant, as well as some personal data. The main information you need to run a credit check on non-commercial tenants include:

- The applicant’s full legal name

- Address history for at least two previous addresses

- Social security number

- Employer name

- Former landlord name

- Date of birth

- Express permission to run a credit check

3. Request a tenant screening credit report

Credit reports provide insight into a tenant’s financial responsibility. These reports reveal credit history, including debts, payment history, and credit score. It helps predict the tenant’s ability to meet rent obligations.

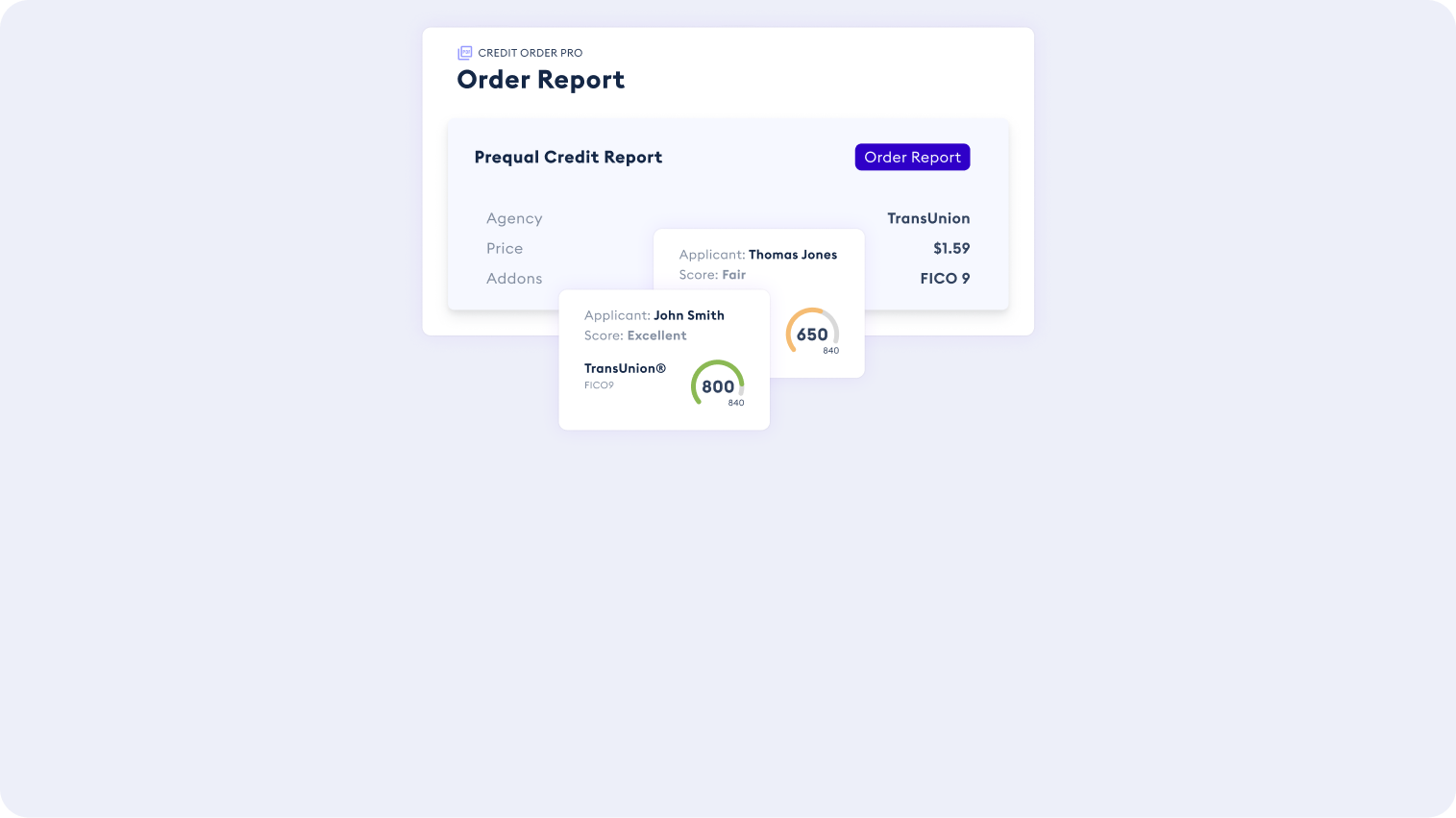

CRS offers the shortest, quickest, and least expensive path to the tenant credit information you need. CRS’s API allows you to perform a soft-pull credit report from Equifax and hard inquiry reports from the other two bureaus from within your property management software or CRM (customer relationship management) program. Our API also provides access to useful background check information, such as the tenant’s criminal records.

4. Run a background check

During this process, you may want to conduct a comprehensive background check that includes criminal history. This information is crucial for ensuring the property’s and its residents’ safety and security.

Likewise, check a tenant’s eviction history and get in touch with their current employer or landlord to learn more about the person. Again, if you conduct a tenant eviction check, be aware of fair housing laws and avoid discriminating based on protected characteristics.

5. Interview applicants

Some property managers go the extra mile and interview applicants to make sure they are who they say they are. This is a good option if you receive applicants from renters with no credit history and no previous landlords, such as students or new residents from overseas. Some questions you may want to ask include:

- Tell me about yourself and your living situation. This open-ended question can reveal details about the applicant’s background, lifestyle, and communication skills.

- How many people will be living with you? This helps determine if the unit can comfortably accommodate the applicant and their household.

- Are you employed? If so, what is your occupation and income? This information will help assess the applicant’s ability to afford rent.

- Have you ever broken a lease agreement? If so, why? This can indicate potential problems with adhering to rental terms.

- Why are you moving and when would you like to move in? This provides insight into the applicant’s motivations and their desired timeline.

- What are your expectations for your living situation? This helps determine if the applicant’s expectations align with the property and your management style

An applicant may have made some of this information available on their application; if so, try to avoid redundancy and simply get any additional details you may need to make a decision.

6. Accept or reject applicants

Use this information to make a fair and reasonable decision about whether to accept a tenant. Document your decision and provide the applicant with a written notice. Keep detailed records of the screening process for each applicant, whether or not you decide to offer them a lease agreement.

Best Practices and Tips for Effective Tenant Screening

Effective tenant screening requires a combination of thoroughness, compliance with laws, and the right tools. Here are some best practices to enhance your tenant screening process.

– Ensure Legal Compliance

Always comply with fair housing laws and other regulations. Avoid discriminatory practices in screening and selection.

– Use Comprehensive Screening Tools

Employ services that offer detailed credit and background checks, as well as eviction history reviews.

– Verify Tenant Information

Cross-check tenant-provided information with public records and references.

– Communicate Clearly

Maintain clear communication with potential tenants about your screening process and requirements.

Breaking Down Tenant Screening Reports

A tenant screening report is a crucial tool in the property manager’s arsenal. It compiles various pieces of information about a potential tenant, providing a comprehensive view of their history and behaviors.

– What’s in a Report

Typically, a tenant screening report includes a credit report, criminal background check, and eviction history. This report may also contain employment verification and previous landlord references.

– Accessing Credit Reports

Obtaining a tenant’s credit report is a delicate matter, requiring consent and compliance with legal standards. A credit report offers a snapshot of the tenant’s financial health, including their credit score, debt history, and payment reliability.

– Evaluating Eviction and Criminal History

Beyond financial stability, understanding a tenant’s past behavior is crucial. An eviction history can flag potential future issues, while a criminal background check helps ensure the safety and security of your property.

– Accessing Credit Reports and Tenant Eviction History

Getting access to a potential tenant’s credit and eviction history can be challenging without the right tools. Property managers must navigate the tricky web of legal requirements and data sources to gather this information.

Before accessing a credit report, ensure you have the tenant’s written consent, adhering to legal guidelines. Then, for accurate and comprehensive data, utilize reliable sources and services that provide detailed credit and eviction history.

Transform Your Tenant Screening Process with CRS

CRS offers a unique, all-encompassing solution that provides easy access to essential tenant screening information while ensuring compliance and affordability. Whether you manage a small local property or a large portfolio, CRS equips you with the tools and data needed to make the best tenant selection decisions possible.

Our platform is a comprehensive solution in the tenant screening landscape, providing a single platform for credit, fraud, and compliance needs. It makes the tenant screening process faster, more affordable, and more efficient.

- Single Credit API Connection: CRS’s technology simplifies access to various data sources, offering property managers instant and reliable information.

- Guided Compliance: With CRS, you navigate the complexities of compliance easily, ensuring your screening processes adhere to legal standards.

- Tailored for All Business Sizes: CRS caters to businesses of all sizes, making advanced tenant screening tools accessible to everyone, especially small and medium-sized businesses that might otherwise be overlooked by large credit bureaus.

CRS integrates with major credit bureaus and data providers for a more streamlined and efficient way to access crucial tenant information.

For instance, CRS provides instant access to credit reports, criminal records, and eviction data through a single API connection. This simplified and efficient approach reduces what was formerly a very time-consuming process, allowing property managers to make faster and more informed decisions. Plus, the cost-effective solution of CRS makes it particularly attractive and beneficial for small and medium-sized businesses.

Discover how CSR can make your tenant screening process more efficient, compliant, and reliable.