Why Are Credit Scores Different Across Credit Bureaus?

October 26, 2023

Language surrounding the financial world often paints credit scores as a singular, universally accepted metric for assessing an individual’s creditworthiness. However, the reality is quite different and much more nuanced – but it’s not a mystery. Why might a person have three different credit scores? For starters, there are three major consumer credit bureaus – Experian, Equifax, and TransUnion – and each provides individuals with a unique credit score. And yet, each score rarely lines up with others.

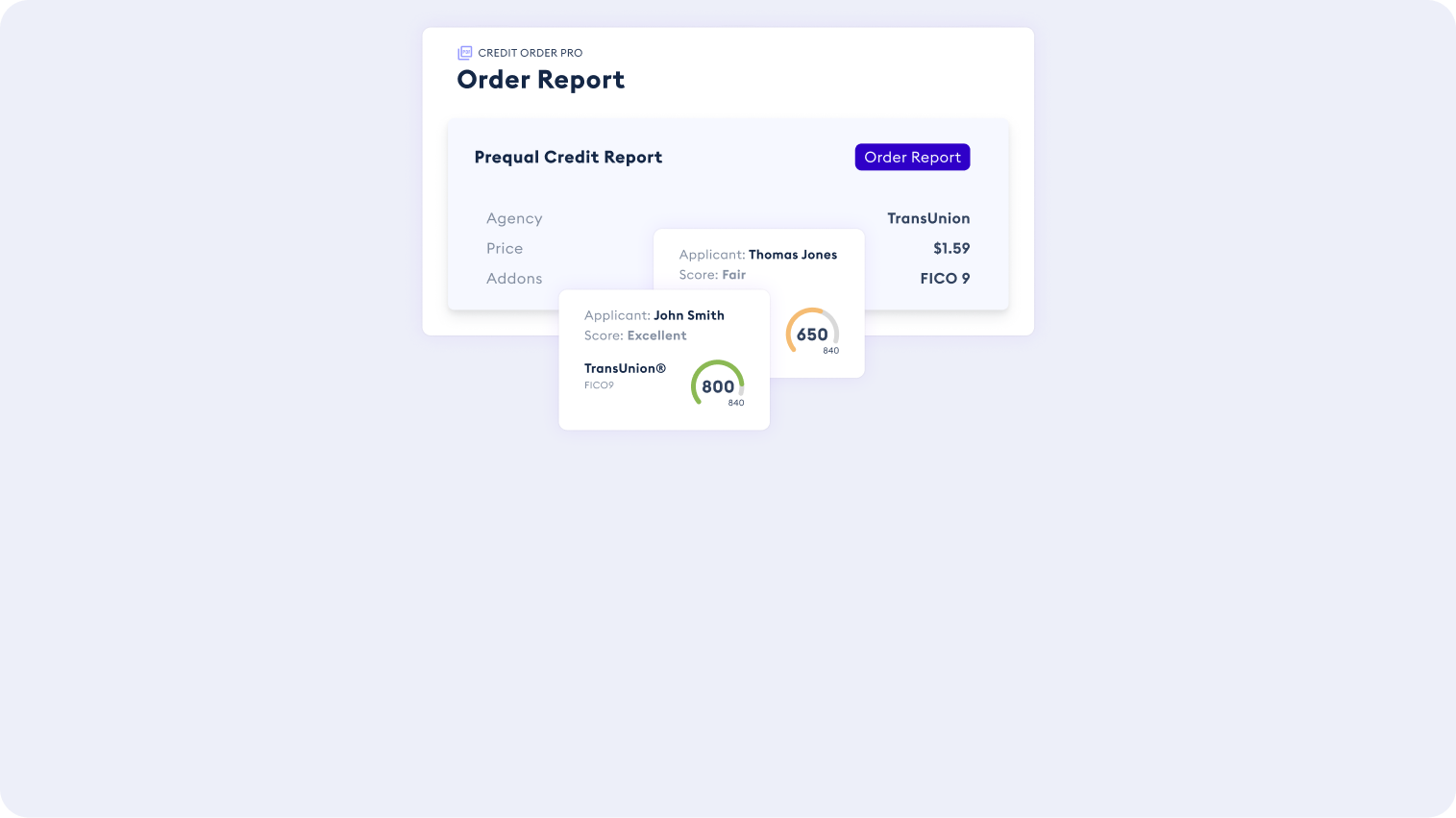

From a business perspective, credit scores play a major role in how potential customers choose to spend or invest their money. Further, they are vital when deciding on how to interact with potential customers. Whether you work in consumer lending, business lending, tenant screening, bankruptcy, or something else, a clear understanding of a potential customer’s credit score is vital for making informed business decisions. Implementing an easy way to look at credit scores makes the process easy for all parties.

We’ll break the difference between credit bureau scores, how they affect individuals and lenders, and highlight the differences between each score. Let’s dig in.

Understanding the Credit Bureaus: Why Are There Three Credit Bureaus?

Before we get into the details of credit score variations, it’s important to understand the three major credit bureaus. People often mistakenly think that there are three different credit scores, but in fact, there are simply three different credit bureaus that provide access to credit reports. These are the details.

- Experian: Established over 125 years ago, Experian – a California-based company – places a strong emphasis on financial data, security, and credit monitoring. They have been helping individuals monitor their credit for over a century.

- Equifax: Equifax positions itself at the convergence of technology, finance, and data analytics. They prioritize economic inclusion and aim to enhance accountability and integrity in financial markets.

- TransUnion: Similar to the other two bureaus, TransUnion utilizes credit data and public records to generate a report, helping inform decisions made between consumers and lenders.

All three bureaus operate under the regulation of the Fair Credit Reporting Act (FCRA), which protects consumers’ rights and, in turn, drives data accuracy. The bureaus collect consumer and business data and package it up into holistic credit reports. For businesses seeking credit scores, credit reports, and other regulated financial data, it can be a resource-intensive process to gain approval from the bureaus to pull those credit reports.

However, CRS is a CRA that partners with the credit bureaus and other data providers to offer the leading independent credit data API that provides a new way to access all-in-one credit data solutions, in a fraction of the time. Whether you need credit data for your business or want to empower your customers to see their credit scores, CRS covers all credit and compliance needs across industries..

Behind the Scoring Models: How Is a Credit Score Generated?

One of the main reasons credit scores differ across bureaus is because of scoring models. The bureaus look at similar data, but apply different methodologies to how they calculate the specific score and crunching the numbers. The two prominent scoring models used by these agencies are the FICO Score and VantageScore, both with their own unique approach.

FICO

- Payment history (35%): Timely payments result in higher scores.

- Amounts owed (30%): High credit utilization can negatively impact a score.

- Length of credit history (15%): A longer history can be beneficial.

- Credit mix (10%): A variety of credit types is considered positive.

- New credit (10%): Opening multiple accounts in a short period can lower a score.

FICO places heavy emphasis on payment history, amounts owed, and the length of credit history, which collectively account for 80% of a score. Focusing on these areas can significantly improve a FICO score.

VantageScore:

- Payment history (41%): Payment behavior is extremely important.

- Utilization (20%): The proportion of credit used compared to limits matters.

- Age/mix (20%): Evaluates the depth of credit history.

- New credit (11%): Multiple recent accounts can negatively impact a score.

- Balance (6%): Examines total reported balances, both current and delinquent.

- Available credit (2%): Considers total available credit.

VantageScore places a greater emphasis on payment history, utilization, and credit age. Similar to FICO, focusing on these key factors can improve VantageScore.

Score Tiers: Making Sense of a Credit Score

To add another layer of complexity, credit bureaus categorize credit scores into different tiers. While these categories may differ between FICO and VantageScore, they serve a similar purpose:

FICO:

- Exceptional: 800-850

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

VantageScore:

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 300-600

Understanding a score’s tier is very important, as it can significantly impact the potential financial prospects when approaching a lender. This is why managing credit behavior is one of the best habits someone can develop. Further, it arms businesses with data to make more informed financial decisions.

Different Credit Scores Paint Holistic Pictures

It might be confusing why the world needs multiple credit scores reported by multiple credit bureaus, but it’s simply a reflection of how the financial world keeps track of behaviors to make decisions. And, it’s not hidden information. People not only have the right, but should regularly check their credit scores and how they appear in different bureaus to be better equipped to navigate the intricacies of credit scoring and improve their overall financial positioning.

The credit bureaus give free weekly online access for consumers wanting to view their own credit reports. The credit bureaus aren’t the only ones – consumers can also request their files from LexisNexis to see their personal information

In the modern financial world, good financial decisions and habits foster good credit scores, regardless of the bureau. Those who stay informed, monitor their credit diligently, and make wise financial choices lay the foundation for a future filled with financial positivity and success.

By providing your customers with easy access to this information, you can help foster a healthy environment for smart financial decisions by all parties. Talk with CRS credit data experts to learn how all-in-one credit and compliance solutions boost financial decisioning.