Every year, online lending leaders gather at LEND360 to explore fintech industry trends, technologies, and strategies and their impact on consumer and small business lending. In 2023, hundreds of lenders, bank representatives, fintechs, and software and service providers for the lending industry convened in Atlanta, Georgia, October 2nd-4th.

Two main drivers of 2024 lending industry dynamics that surfaced are economic and technological in nature. With growing concerns about an impending recession, lenders are looking closely at lending requirements, guidelines, and compliance. When it comes to new technology, AI sees no boundaries for disrupting industries – even those historically underserved by modern technology. Albeit an uncharted territory for AI, it’s finding its way into online lending, but there are concerns to be addressed before full-scale adoption.

Lending in a Recession: Cautionary Tactics

During a recession or economic downturn, lenders often adjust their strategies and tactics to manage risk and continue operating profitably. With the online lending industry bracing itself for a recession that has been and continues to be anticipated at every next turn, we’re seeing a shift in lending tactics. Here are some trends and tactics we could see more of in consumer and business lending.

Tighter Credit Standards

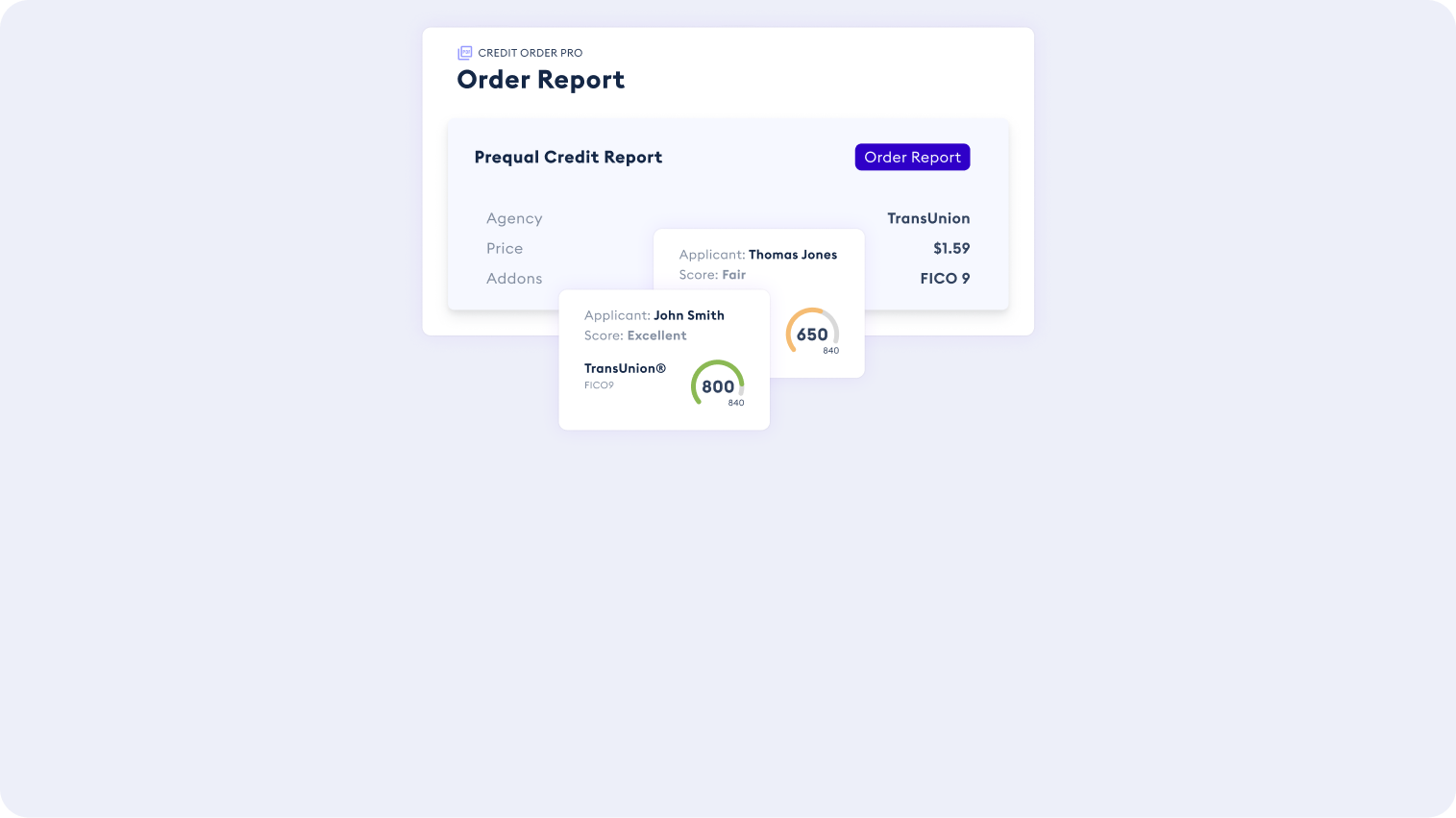

Lenders may become more selective about the borrowers they approve. They may raise minimum credit score requirements, require larger down payments, and scrutinize applicants’ financial histories more closely. This requires more robust, comprehensive consumer and business credit data. Easier access to complete credit data will support recession-ready lending practices.

Reduced Loan Amounts

Lenders may limit the size of loans they offer to reduce their exposure to risk – one of many ways lenders can mitigate risk during uncertain times. Smaller loan amounts mean smaller potential losses in case of default.

Increased Interest Rates

Lenders may charge higher interest rates to compensate for the increased risk associated with lending during a recession. This helps maintain their profit margins. A change in interest rate algorithms also warrants a fresh look at the data powering them. What was challenging in the past – leveraging regulated financial data from multiple sources, for example – could now be feasible and affordable for the online lending industry.

Diversified Loan Portfolios

Lenders may diversify their loan portfolios across different sectors or industries to spread risk. By not concentrating their lending in one industry heavily affected by a recession, they can mitigate losses. Looking at new, combined, or alternative datasets can help expand and diversify the pool of potential loan applicants. For small business lenders, FICO SBSS is a reliable, government-backed source for business data and risk analysis.

Loan Portfolio Stress Testing

Lenders may conduct stress tests to assess how their loan portfolios would perform under adverse economic conditions. This helps them identify potential weaknesses and take proactive measures to mitigate losses.

Loan Modifications

Instead of immediately foreclosing on delinquent borrowers, lenders may offer loan modifications, such as extending loan terms or temporarily reducing interest rates, to help borrowers weather the recession and avoid default.

Retaining & Growing Existing Customers

Lenders often prioritize existing customers who have a proven track record of repayment. They may offer special incentives or preferential terms to retain and expand relationships with these borrowers.

Improved Customer Education

Lenders can engage in customer education efforts to help borrowers understand their financial options during a recession. This can include providing information about hardship programs, financial counseling, or debt consolidation.

Attention to Regulatory Compliance

Lenders must stay abreast of changing regulations, especially during economic downturns when government agencies may implement new rules or relief programs. Compliance is critical to avoid penalties and maintain trust with regulators. Compliance requirements are the mission critical task that most businesses hate to manage – it can be challenging to stay ahead of requirements, audits, and guidelines from each credit bureau and data provider. CRS is the only modern, tech-enabled CRA that provides ongoing compliance services to customers. We deal with the bureaus, so you don’t have to.

Many believe a recession is looming, but it’s not yet in full swing. So, while these are all valid and valuable considerations to prepare for and navigate economic instability, the specific tactics employed by lenders will vary depending on the nature and severity of the recession, as well as the lender’s size, industry, and regulatory environment. Of course, government policies and stimulus programs can also influence lenders’ strategies during economic downturns.

Mitigating Risk in the Lending Process

Now is no time for lenders to be in a vulnerable position. Online lenders should fortify their defenses and protocols against risk, fraud, and lax lending. There are different types of risk that are considered when consumer and business lenders extend credit.

- Default Risk: This is the most fundamental form of credit risk. It refers to the likelihood that a borrower will fail to meet their obligations, such as missing loan payments or not repaying a loan in full. Default risk can be influenced by factors like the borrower’s credit history, financial stability, and overall ability to repay.

- Credit Spread Risk: Credit spread risk, also known as yield spread risk, relates to changes in the spread between the interest rate on a particular credit instrument (e.g., corporate bond) and the risk-free rate (e.g., government bond yield). If the spread widens, it can indicate increased credit risk in the market, potentially leading to a decline in the value of the credit instrument.

- Concentration Risk: Concentration risk arises when a lender has a significant portion of its exposure concentrated in a particular industry, geographic region, or group of related borrowers. If adverse economic conditions impact that specific area or industry, the lender’s portfolio could suffer significant losses.

- Liquidity Risk: Liquidity risk is the risk that a borrower may not have the necessary funds to meet their short-term financial obligations. This can lead to difficulties in repaying loans, even if the borrower has the ability to do so in the long term. Lenders often assess liquidity risk to ensure borrowers can manage their immediate financial needs.

- Institutional Risk: Banks may encounter institutional risk if there is a breakdown in the legal structure. Institutional risk may also occur if there is an issue with an entity that oversees the contractual agreement between a lender and a debtor.

The accuracy, completeness, and reliability of credit scores, credit reports, and related financial data and analysis is crucial to lenders’ ability to make informed lending decisions. Lenders can level up with complete credit data for more powerful decisioning flows. Additionally, risk mitigation strategies, like diversification of loan portfolios, collateral requirements, and loan covenants, are also used to manage credit risk effectively.

With loan acquisition still below pre-pandemic levels, lenders and fintech companies are looking at different risk assessment strategies to safely, profitably lend in today’s market. A LEND360 session, “Lending in Turmoil – Tactics to Win and Grow During a Recession,” addressed the fact that the loan acquisition and portfolio-building strategies of five years ago simply aren’t delivering the same results today. So, what’s the strategy for our current economic climate?

A “predictable, repeatable, scalable” and data-driven approach to pre-screened credit targeting. The fundamental challenge for lenders: how to balance risk with profit.

Credit Scoring Models, Risk & Rates

The accuracy, completeness, and reliability of credit scores, credit reports, and related financial data and analysis is crucial to lenders’ ability to make informed lending decisions. Ensuring lenders have consistent access to sophisticated credit scoring models that consider many factors like credit history, income, employment stability, and debt-to-income ratio helps accurately evaluate credit risk.

This data also helps adjust interest rates and loan terms based on that perceived risk of the borrower. In fact, lenders may implement risk-based pricing strategies, where they customize interest rates and terms based on individual borrower risk profiles. This allows lenders to align pricing more closely with the specific level of risk associated with each borrower.

Credit & Portfolio Monitoring, Compliance & Risk Assessment

Lenders should continually monitor their loan portfolios, assessing the credit quality of borrowers and identifying potential risks. This allows for proactive risk management and timely intervention in case of deteriorating credit conditions. Ongoing and consistent access to credit data and other key financial information on consumers and businesses is crucial for lenders to stay aligned with not only the economic climate, but also the ever-changing creditworthiness of their borrowers. To retain access to regulated data, ongoing compliance management is a must, but also a major headache for lenders – and, any business working with credit data for that matter. This is why CRS focuses on delivering the most comprehensive credit data solutions that are always coupled with compliance guidance.

AI in Lending: Credit Data-Powered Processes

AI’s strength is in its ability to analyze vast amounts of data, including non-traditional data sources (like transaction histories), to assess the creditworthiness of borrowers more accurately. Thus, the first step in this journey is to prepare data from disparate sources, so it can potentially be leveraged for data-rich, automated credit and risk analysis. Because, concerns about data privacy, bias, and ethical considerations are a big part of this conversation.

Traditionally, it’s been a challenge in this industry to easily, efficiently, and affordably access credit data and other financial data from different providers. When you add the nuances and complexities of seemingly similar data products, plus the compliance requirements that must be met to even access them, it can grow to be a tangled web of details.

AI is undoubtedly entering the lending sphere – from assessing credit risk to monitoring to fraud detection, there are many promising applications. With all the excitement around automated possibilities, we must not forget to ensure the data we feed it is ready for the application. And, it’s time to consider concrete ways to responsibly expand the amount of data leveraged for automated decision-making.

Lenders see the need, now more than ever, for complete credit data solutions that allow for the freedom and flexibility of incorporating alternative data sources. This is exactly why CRS is breaking down the barriers to access to better financial data with all-in-one credit data solutions that power data-driven financial decisions across industries. Prepare your business for better risk mitigation in light of a looming recession and AI’s impact on lending. Talk with CRS about what your custom-fit, all-in-one credit and compliance solution looks like. Gain access to an ever-expanding library of credit, regulated, and alternative financial data to power better, data-driven lending decisions.