As we approach the end of 2023, the commercial lending landscape has certainly experienced its fair share of ups and downs. Financial institutions started the year concerned with the rising impact of inflation and higher interest rates, coupled with supply chain disruptions and the threat of a recession.

“Whether it is the increasing rate environment, uncertain economic times or tightening liquidity, credit unions and business members face a much tougher lending environment in 2023 than they have seen in quite a while,” wrote the Credit Union Times.

Overall, commercial lenders navigated a complex environment in 2023 by adopting a more cautious and data-driven approach, while adapting their products, services, and communication strategies. Entering 2024, the International Monetary Fund forecasts global GDP growth to slow down further, increasing the risk of recession — a dynamic that could lead to tighter credit conditions, reduced loan demand, and potential loan defaults.

With this backdrop in mind, here are the emerging commercial lending trends to know for a sector poised for growth, all while maintaining a strong risk management framework.

Economic Uncertainty and Rising Interest Rates

Today’s high-interest rates are impacting virtually every sector of the economy, from mortgage lenders to speedboat retailers. Central banks globally have been raising rates to combat inflation, making borrowing more expensive for businesses. Higher interest rates along with global events like the Ukraine war and the Israel-Hamas conflict have led to greater economic uncertainty that commercial lending institutions can’t ignore.

Many lenders are mitigating this risk by implementing stricter credit criteria. The Federal Reserve’s quarterly Senior Loan Officer Opinion Survey (SLOOS) showed in January a net 50.8% of banks tightened credit terms for commercial and industrial (C&I) loans to medium and large businesses, up from 46% in the previous poll. It also indicated that this trend was expected to continue through the end of the year.

In practice, this means loan approvals for many commercial lenders may require higher minimum business credit scores, stricter debt-to-equity ratios, and more thorough collateral requirements.

Cost Optimization Driving Technology Adoption

High-interest rates impact how lenders run their business, not just how they’re able to offer loans. “Banks are reflecting higher funding costs in their loan pricing models, but they should also consider accounting for an increase in the cost of capital and customer acquisition costs,” wrote Deloitte.

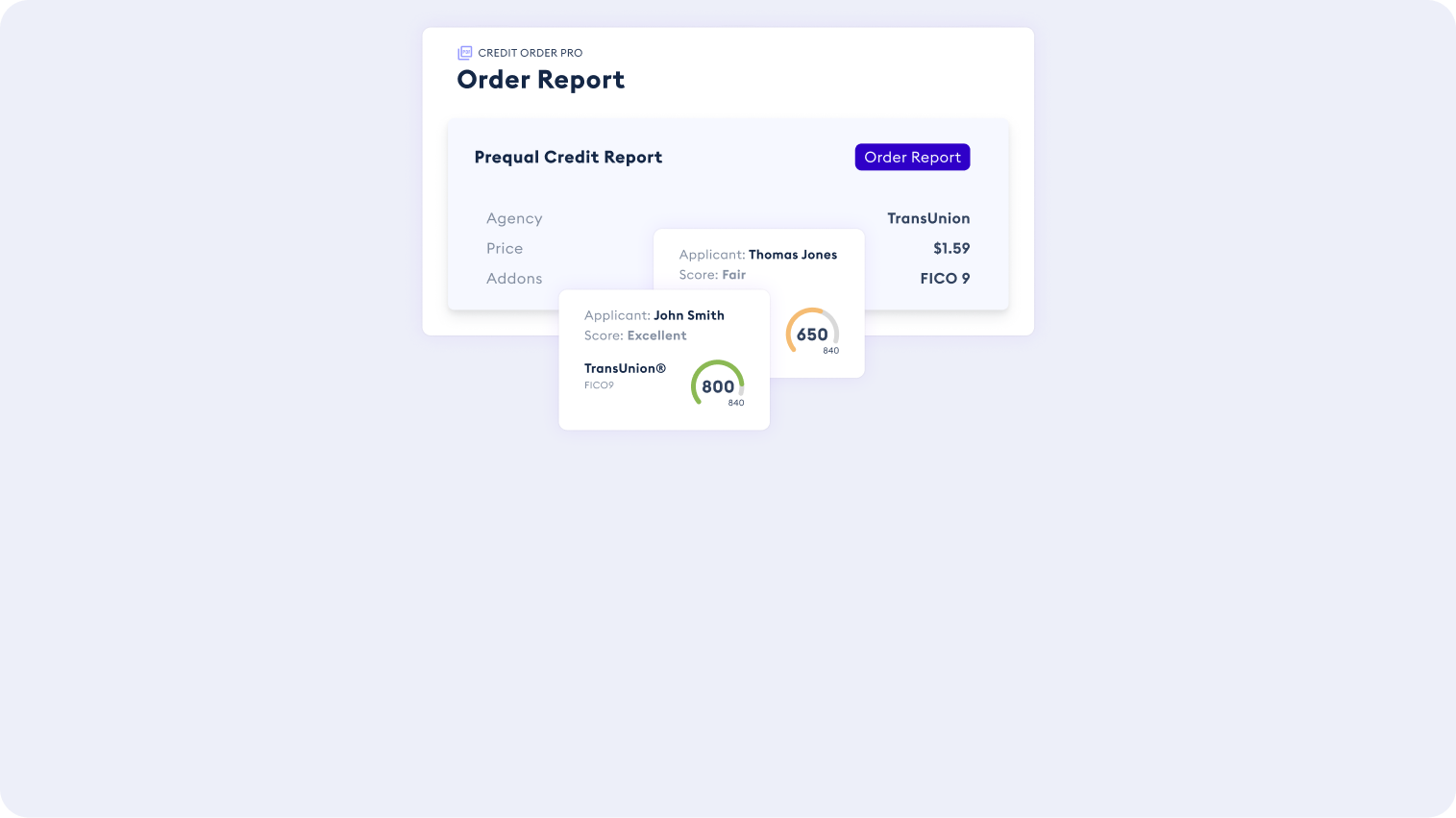

One way to mitigate an increase in operating costs is to adopt new technologies that streamline the lending process. For instance, CRS’ industry-leading credit data API provides reliable access to credit data with direct connections to all major bureaus. CRS customers get unmatched time-to-market streamlined compliance and vetting, saving time and money.

CRS’ business credit reports can help mitigate the risk of working with the wrong business while providing the data you need to make better business decisions.

Using Data to Make Better Decisions

More institutions are seeking to use alternative data alongside traditional data in their commercial lending process. At Fintech Nexus USA 2023, conversations centered around the role of both traditional credit and alternative data to power financial flows, pre-qualification processes, lending and underwriting operations, and decision engines.

Alternative data has the potential to supplement commercial lending processes and expand the potential pool of customers for lending institutions. However, it takes the right commercial lending software to ensure this data is used compliantly and in a low-risk model.

CRS developed an all-in-one API that not only provides access to various data products from bureaus and other providers but also includes business verification tools. Our agile, tech-forward approach to regulated financial data has proven to save companies valuable time and resources. We expect lenders to continue to leverage advanced analytics and data tools to gain deeper insights into borrowers’ financial health and business activities, making more informed lending decisions in 2024.

Compliance Taking High Priority

Changing regulations, such as the upcoming Basel norms, put pressure on lenders to avoid penalties and maintain trust. Compliance is even more important in the face of an economic downturn, when government agencies may implement new rules or relief programs. Commercial lending organizations are looking for new ways to make compliance easy.

CRS is the only modern, tech-enabled CRA that provides ongoing compliance services to customers. We work closely with credit bureaus to offer painless access to credit data and help you navigate this complex and highly regulated industry.

Increased Competition in Commercial Lending

Commercial lending is only getting more competitive with the rise of fintech and changes in the way corporate customers seek financing.

“For pragmatic reasons, many corporate customers tend to spread their banking relationships across a number of institutions, thereby adding to the competition for wallet share,” wrote Deloitte. “Moreover, nonbank lenders are increasingly funding leveraged buyouts by private equity firms, taking away shares from banks in the syndicated leveraged loan market.”

Commercial lenders face classic pain points, such as multiple approval rounds for loan applications and repetitive requests for information from customers. To stay ahead in the market, they are turning to commercial lending software that improves customer relationships and boosts their competitive edge.

CRS offers the shortest, quickest, least expensive path to making a lending decision — resulting in a better experience for your customers. Commercial lenders can get the information they need to make decisions without long wait times for loan applicants. Ultimately, this helps with customer retention — the holy grail of business growth.

Get Ready for 2024 with CRS

In general, the commercial lending outlook for 2024 is cautiously optimistic, with both challenges and opportunities looming on the horizon. Businesses and lenders should closely monitor economic developments, focus on making data-driven decisions, and pay attention to the customer experience to navigate the uncertain landscape.

CRS is here to guide you to success. We provide technology designed to make your life easier, exceptional customer service, and decades of industry expertise. Our credit data API gives you access to reliable consumer and business credit reports. Get in touch with our Sales team to learn more about CRS.