Credit reporting agencies provide an invaluable service to lenders and businesses that seek financing. These agencies give lenders the information they need to assess a borrower’s creditworthiness and make informed lending decisions. Credit reporting agencies act as intermediaries between borrowers and lenders, ensuring that credit information is accurately collected, maintained, and shared in a responsible manner.

In this guide, we’ll dive deep into what a credit reporting agency is, the differences between different credit bureaus, and how these agencies get their information that can help lenders make better decisions.

What is a credit reporting agency?

A credit reporting agency is a company that collects and maintains historical credit information on individuals and businesses. Sometimes known as credit bureaus, these agencies collect data from lenders, credit card companies, utility companies, and court records. This data is consolidated into credit reports that include a business’ or individual’s credit score.

In the United States, there are three major consumer credit reporting agencies: Experian, Equifax, and TransUnion. Experian and Equifax offer business credit reporting along with Dun & Bradstreet.

Why are there three credit reporting agencies?

The three major credit reporting agencies exist to promote competition, reduce risk, and ensure consumer fairness and privacy. Having multiple credit bureaus fosters competition among Equifax, Experian, and TransUnion, encouraging each bureau to constantly refine its data collection and reporting processes to guarantee accuracy and completeness.

Three separate agencies also provide a fail-safe in the case of a data breach. If there were only one credit bureau, a single system failure could have a catastrophic impact on the entire financial system. Three bureaus reduce this risk and help protect consumers and businesses from hacking attempts.

The Fair Credit Reporting Act (FCRA) establishes guidelines for credit bureaus, ensuring they operate fairly and protect consumer privacy. Having multiple bureaus makes it more challenging for any single entity to gain excessive power or influence over the credit reporting system.

What are the differences between the credit reporting agencies?

All three credit bureaus collect similar types of information and provide similar services, including identity monitoring, credit scores, and other financial tools. They differ in how they calculate credit scores and process that information.

Credit reporting agencies use one of two models to analyze a credit report to generate a number: the credit score. FICO and VantageScore are the two models used by the three credit reporting agencies. FICO scores are based on credit data from a single credit bureau and requires a credit account with a history of not less than six months. VantageScore, on the other hand, combines information from all three bureaus and may be created with only one credit account, regardless of the history.

Experian

Experian is the largest credit bureau in the US, maintaining credit information for over 220 million consumers. It uses the FICO credit score range of 300-850. A key differentiator for Experian is that it collects rental payment data from landlords who report this information. To calculate credit scores, Experience takes into account these factors:

- Payment history (35%)

- Credit utilization (30%)

- Credit age (15%)

- Different types of credit (10%)

- Number of inquiries (10%)

Equifax

Equifax is the second-largest credit bureau after Experian. Equifax also uses the FICO scoring model, with a range of 280-850. To calculate its credit score, Equifax uses the following factors:

- Payment history (35%)

- Credit utilization (30%)

- Credit age (15%)

- Different types of credit (10%)

- Number of inquiries (10%)

TransUnion

Finally, TransUnion serves international customers in over 30 countries in addition to US-based individuals. TransUnion uses a FICO score range of 300-850, and weighs payment history and credit age more than the other two credit bureaus. These are the factors that TransUnion uses to calculate a credit score:

- Payment history (40%)

- Credit utilization (20%)

- Credit age (21%)

- Recently reported balances (11%)

- New credit (5%)

- Available credit (3%)

While the different credit reporting agencies have different ways of calculating a credit score, they are all equally valid and considered authoritative by lenders and financers.

How do credit agencies collect and use information?

The three credit reporting agencies get their information from a variety of sources. The agencies do their own research using public records, such as bankruptcy filings, property records, and court records. And, they get information from partners in different industries.

“Banks, credit unions, retail credit card issuers, auto lenders, mortgage lenders, debt collectors, and others voluntarily send information to credit reporting companies,” explained the Consumer Financial Protection Bureau.

Credit reporting agencies typically keep information in credit reports for seven years, with the exception of bankruptcies — these stay on a credit report for ten years.

Credit reporting agencies use the information to create and sell credit reports to lenders and other authorized parties. They also allow consumers to monitor for fraud, freezing their credit reports to prevent unauthorized access. TransUnion, Experian, and Equifax all offer fraud alerts that tell potential lenders to take extra steps to verify a person’s identity before approving a loan.

How can credit reporting agencies help lenders?

Credit reporting agencies provide lenders with the information they need to make informed lending decisions, manage credit risk, prevent fraud, comply with regulations, and more. They play an essential role in the lending industry and contribute to the overall health of the financial system.

Credit reports provide lenders with a detailed overview of an individual’s credit history, including their payment habits, debt levels, and credit utilization. This helps the lender determine whether or not to approve a loan based on the risk assessment and set appropriate interest rates and credit limits based on the borrower’s credit profile.

Credit reporting agencies also help reduce the risk of fraud by providing lenders with information about potential red flags, such as recent address changes or multiple credit inquiries in a short period of time.

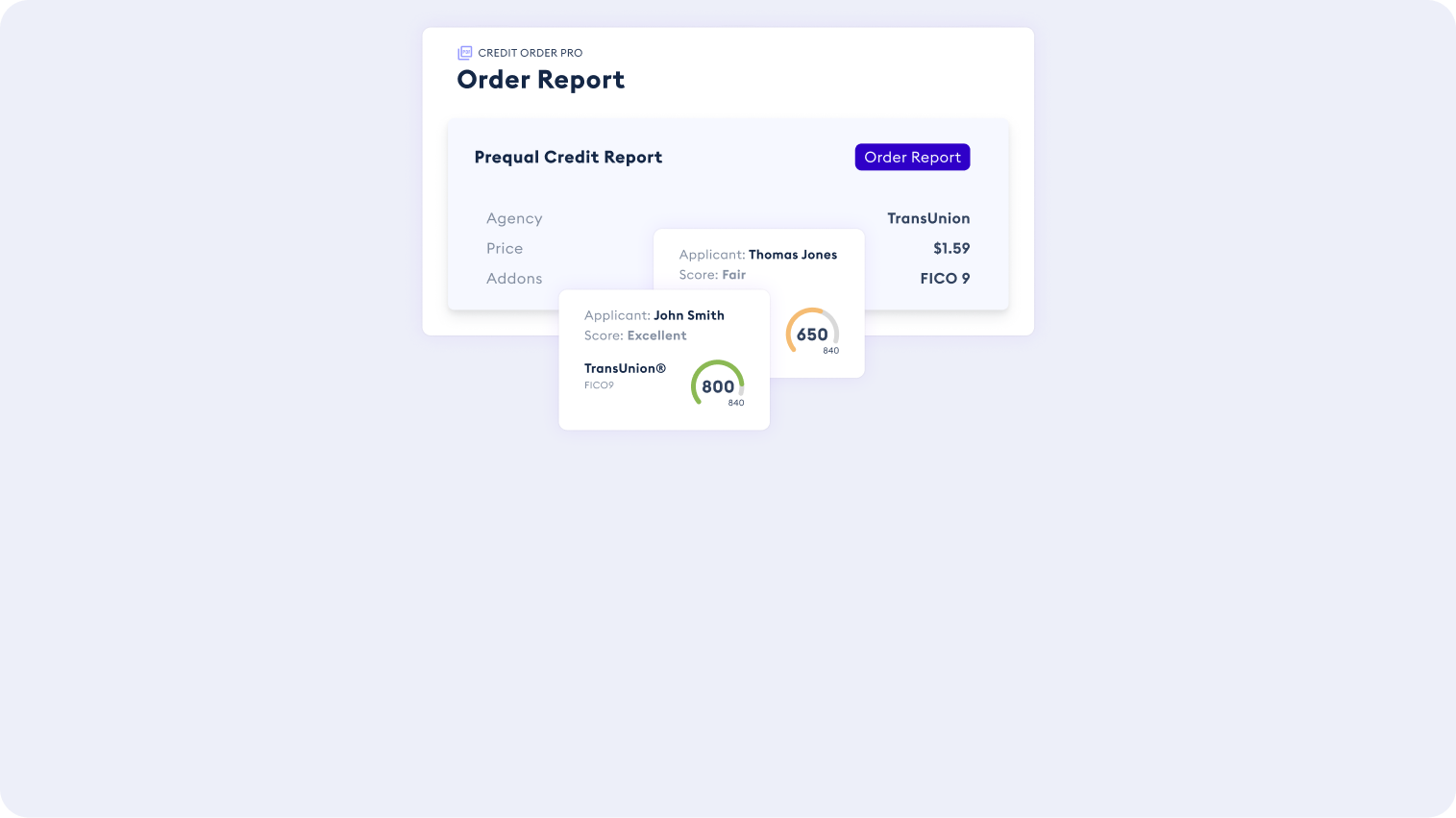

Get Streamlined Credit Data Access with CRS

The information gathered by credit reporting agencies is crucial for lenders. But, accessing these reports can often be time-consuming, challenging, and expensive. CRS alleviates this hassle by streamlining credit data retrieval for lending businesses. Our compliance-ready platform delivers credit reports in a fraction of the time.

Our credit API aggregates data from Equifax, Experian, and TransUnion, so that you can be sure that you only approve qualified borrowers. CRS offers a single point of access for all the data you need from a single user-friendly API. One source, one insertion order, and one streamlined process result in the insights you need to make more informed decisions about consumer and commercial lending.

Learn more about CRS’ platform and how we help lenders access credit reports from all the credit bureaus. Get in touch to get started.